The Most Popular Keywords on Google Play in 2024

In this article, we analyze the most popular keywords and compare them with past trends to identify new tendencies and confirm existing ones. Each year, Google Play surprises us with new developments, and 2024 is no exception.

What We’ve Prepared:

- A review of the Google Play market in 2024

- Comparison of popular keywords from 2021–2023 with the current year

- Analysis of the proportion of branded versus non-branded queries

- And, of course, conclusions

Google Play Market Overview 2024

Google Play, launched in 2008, continues to evolve and strengthen its position in the mobile app market in 2024. The platform is expanding its global presence, attracting millions of new users and developers worldwide. This growth drives an increase in the number of apps available while also improving their quality and profitability. Google Play remains the leading platform for distributing Android mobile applications, offering developers monetization tools and users access to diverse solutions for daily life and business needs.

According to data from 42matters, by the end of 2024, the platform hosts over 2.1 million applications published by approximately 613,000 developers. Among this significant number of apps, about 66,000 are paid, while most free apps are monetized through in-app purchases (IAP) and subscription models. These figures highlight that Google Play remains a promising platform for consistent earnings within the mobile segment.

Key Observations on App Ratings

Analysis reveals that about half of the apps on Google Play have user ratings and reviews, while the other half lack them. This 50/50 ratio underscores the critical role of App Store Optimization (ASO) in achieving visibility and success. Users often rely on ratings and reviews when selecting an app, making metadata quality and keyword optimization essential for improving search visibility and ensuring an app's competitiveness in this vast marketplace.

Popular Keywords on Google Play 2023-2024

In recent years, branded keywords - queries associated with well-known apps and companies - have dominated search popularity. However, among universal search queries common across most regions, the term VPN stood out, reflecting users' growing interest in privacy and data protection.

In 2024, we anticipate a continued rise in the popularity of keywords related to cybersecurity, AI applications, and remote work tools.

Analyzing recent trends not only helps predict changes but also informs how to adapt ASO strategies. To achieve success in promoting apps on Google Play, it is critical to consider:

- Search Traffic Dynamics: Keywords must remain relevant and align with the target audience's interests.

- Relevance and Competitiveness: Focus on using high-potential keywords with minimal competition.

- Metadata Optimization: Ensure high-quality titles, descriptions, and graphical elements to maximize app visibility.

Google Play’s Prospects and Opportunities

Google Play provides developers with numerous tools to analyze and enhance app visibility, including the Google Play Console and keyword reports. It’s essential to recognize that competition among developers is intensifying. However, the platform’s active user base has also grown, surpassing 3 billion active devices worldwide in 2024.

With a well-executed ASO strategy, developers can improve their apps’ visibility and significantly increase organic traffic and revenue. As 2025 approaches, we anticipate new challenges and fresh opportunities for growth and monetization on the world’s largest mobile platform.

Summary of Popular Keywords 2021–2023

2021: Significant Changes in User Queries Due to COVID-19

The pandemic brought about major shifts in user search behavior. Lockdowns and widespread isolation led to a surge in the popularity of context-specific government apps related to coronavirus and online communication tools. Apps like Skype, Zoom, and Plato became top search terms, driven by the global transition to remote work and the need to stay connected while practicing social distancing. This trend reflected the global situation and the pressing needs of users at the time.

2022: Conflict and Stable User Interests

In 2022, global instability caused by the conflict in Europe did not significantly impact overall trends in user interests. Dating apps and social networks continued to dominate search queries, emphasizing users’ consistent interest in communication and entertainment. Popular apps included Twitter, Facebook, Instagram, TikTok, and Tinder.

A notable development in 2022 was the growing prominence of branded keywords in search trends. This shift reflected changes in user behavior, with individuals increasingly searching for specific, well-known apps and brands rather than generic categories.

2023: The Dominance of Branded Keywords

By 2023, branded keywords solidified their position at the top of Google Play search trends. The share of branded queries in certain countries reached impressive levels:

- USA: 100% (complete dominance of branded queries)

- India: 90%

- Brazil: 90%

- Indonesia: 80%

This global trend demonstrates that users prefer to search directly for specific brands, bypassing broader app categories. This behavior is driven by increased marketing efforts from major brands, enhanced brand recognition, and aggressive advertising campaigns.

By the end of 2023, 80-90% of Google Play search queries were associated with branded keywords, with only minor context-specific queries varying by region. This highlights the importance of branding and building app recognition in a highly competitive market.

Implications for 2024

For developers and ASO specialists, it is crucial to consider this trend in 2024. Success will increasingly depend on:

- Promoting apps through branded searches

- Building a strong app identity

- Optimizing for direct searches

At the same time, it remains important to monitor local trends and context-specific queries to account for regional differences and adapt ASO strategies accordingly. This dual focus on global branding and regional adaptation will be key to thriving in the evolving app marketplace.

What Changed on Google Play in 2024?

To answer this question in detail, let’s examine the key trends for 2024 based on statistics from ASOMobile Top Keywords. For clarity, we’ll analyze the same countries as in 2023: India, Brazil, USA, and Indonesia.

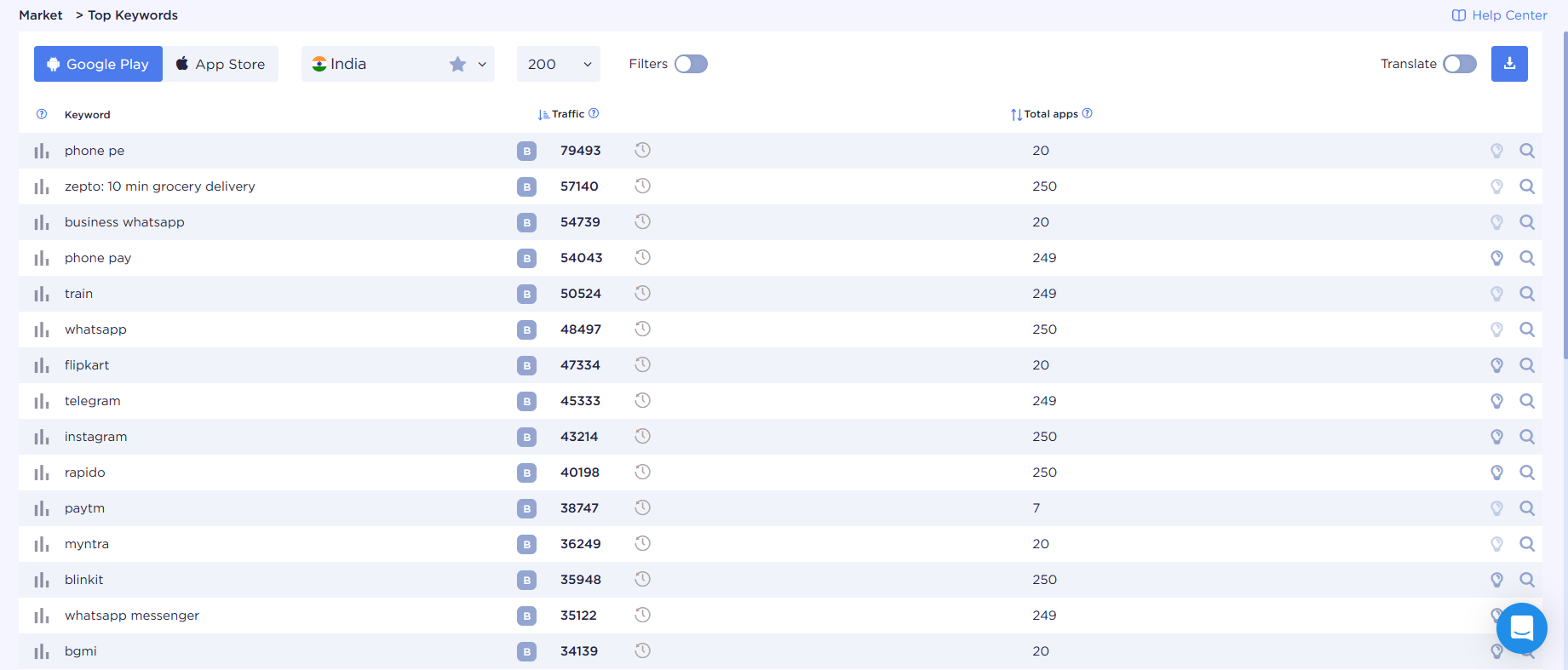

India`s Popular Keywords: Total Dominance of Branded Keywords

In 2024, India demonstrated a 100% share of branded queries among the top 14 keywords. This highlights the consistent user interest in popular apps and their high level of recognition.

- Financial Apps: PhonePe, PhonePay, and Paytm continue to lead as digital payment systems increasingly integrate into Indians' daily lives.

- Messaging Apps: Telegram and WhatsApp (including WhatsApp Business and New WhatsApp) showcase the growing popularity of messengers, both for personal and commercial communication.

- Shopping Apps: Flipkart maintains its leading position thanks to a unique feature allowing users to share selected products with friends for evaluation and joint decision-making. This "social hook" appeals to users who value collective opinions.

- Transportation and Navigation: Train and Navi remain popular queries, reflecting steady interest in apps for travel and commuting.

- Artificial Intelligence: ChatGPT continues to gain traction, reflecting the global trend towards AI technologies for work and education.

- Social Media: Facebook remains in high demand among Indian users.

- Grocery Delivery: Zepto, offering a "10-Min Grocery Delivery" promise, ranked second, underlining the rapidly growing demand for fast delivery services in Indian metropolitan areas.

- Additional Income: Earneasy24 attracts users by offering opportunities to earn money through simple tasks like surveys or CAPTCHA entry. This reflects interest in micro-earnings and in-app economic opportunities.

Thus, 2024 was a year of strengthening the positions of major brands and further growth of innovative apps with niche functional features in India. This provides key insights for ASO specialists and developers targeting the Indian market: focus on functionality, speed of service, and social interaction elements to capture user interest effectively.

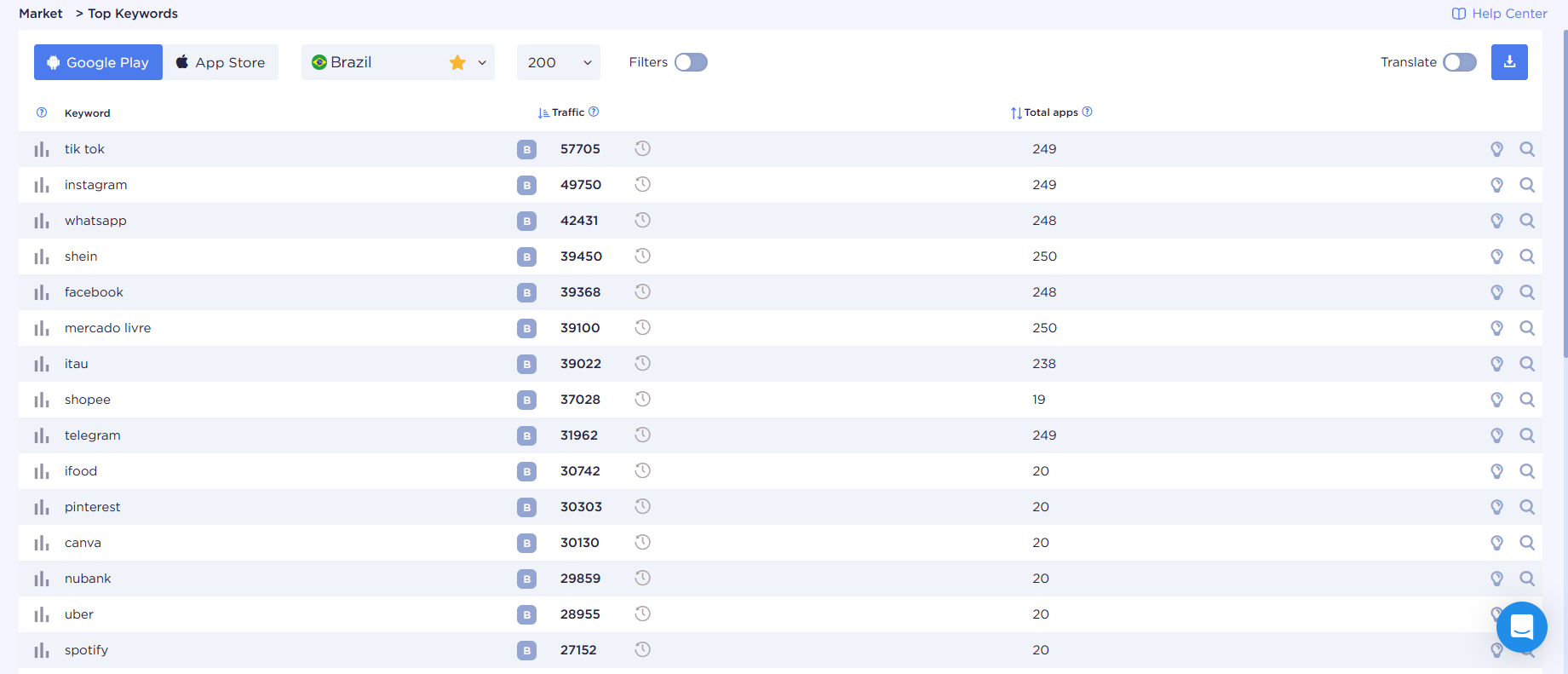

Brazil: Complete Dominance of Branded Queries in 2024

The Brazilian Google Play market shows a 100% share of branded keywords among the top 15 queries. This trend clearly indicates that users in Brazil favor well-known brands that provide functionality, convenience, and reliability.

Social Media and Messengers. Brazilians have a long-standing interest in apps for communication and social interaction:

- TikTok, Instagram, Facebook, and Pinterest remain integral parts of daily life, offering platforms for content sharing and maintaining social connections.

- WhatsApp and Telegram continue to dominate in both personal and professional communication.

Content Creation Tools. Canva enjoys immense popularity for its intuitive functionality. Brazilians actively use the app to create high-quality visual content, from striking avatars to social media designs.

Multimedia and Entertainment. YouTube and Spotify confirm the high demand for video content and music streaming, highlighting the growing popularity of entertainment apps, particularly among younger audiences.

Transportation and Delivery

- Uber remains the leading choice for urban transportation, meeting the demand for convenient and accessible travel solutions.

- iFood leads the food delivery segment, appealing to residents of large cities who value speed and service convenience.

Shopping and E-commerce. Online shopping continues to grow rapidly in Brazil:

- Shopee, Shein, Amazon, and Netshoes are the top platforms for purchasing clothing, electronics, and everyday goods.

- Mercado Livre (MercadoLibre) is a popular app for e-commerce and online auctions, valued for its broad product range and user-friendly tools for buyers and sellers.

Financial Services. Caixa is leading among financial apps, offering access to banking services and digital payment tools.

In 2024, Brazil’s Google Play market is defined by branded dominance, reflecting users’ trust in established apps that provide functionality, ease of use, and reliability. For developers and ASO specialists, succeeding in this market requires a strong focus on branding, metadata optimization, and providing solutions that cater to user needs in social interaction, entertainment, transportation, shopping, and finance.

For developers and ASO specialists, the Brazilian market remains both promising and highly competitive. Success in promoting apps on Google Play will depend on:

- Unique Selling Proposition (USP): Offering a distinct value that sets the app apart from competitors.

- High-Quality Metadata Optimization: Ensuring metadata aligns with relevant keywords and search trends.

- Strong Visual Identity: Creating visually compelling app assets to attract users, especially in a market dominated by major brands.

Thus, in 2024, Brazil reaffirms the trend of branded search dominance, making brand recognition and effective ASO essential elements of a successful strategy.

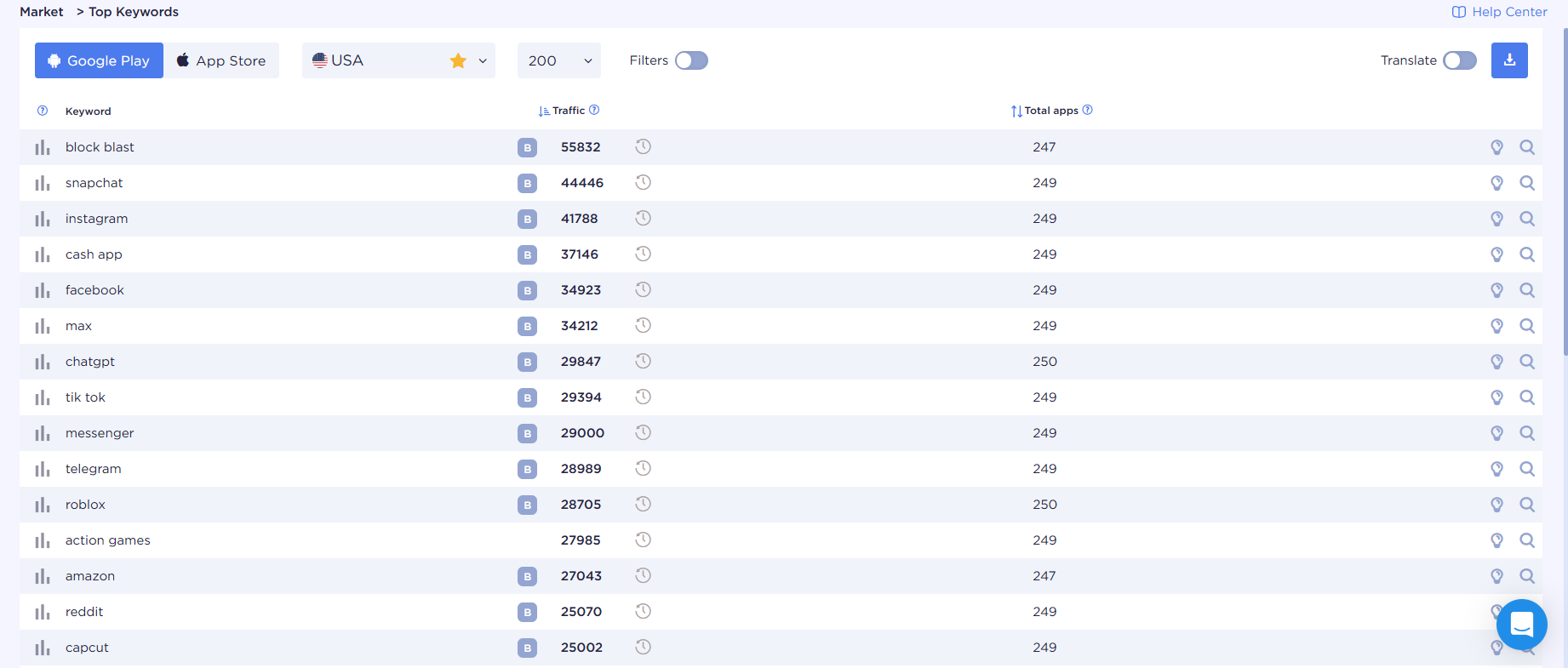

USA: 95% Branded Queries as Popular Keywords in 2024

The U.S. segment of Google Play shows 95% branded keywords among the top 15 queries. Only one non-branded query, "Action Games," deviates from this trend, reflecting user interest in dynamic gaming despite the overall focus on specific brands.

Gaming Apps

Block Blast leads the list, confirming the popularity of casual puzzle games among American users. The U.S. gaming market remains one of the most active and profitable sectors, making it a critical focus for developers.

Social Media: Age-Based Preferences

The American social media market exhibits clear hierarchies based on age groups:

- TikTok: Dominates among younger users, emphasizing the importance of video content and quick engagement.

- Instagram: Popular with middle-aged audiences, continuing the trend of visual content and stories.

- Facebook: Holds its place among older generations, maintaining users with its ease of use and comprehensive functionality.

This indicates a growing "visual generation" in the U.S., favoring dynamic and vibrant content formats.

Messengers and Communication

Americans prefer messengers with additional features:

- Snapchat: A favorite among teenagers and young adults, thanks to its focus on photo and video sharing and temporary stories.

- Messenger: Remains a stable communication tool, especially among Facebook users.

Multimedia and Entertainment

- Max: A popular streaming platform that underscores the high demand for video services offering movies, series, and high-quality shows.

News and Communities

- Reddit: A leading platform for discussing news, finding information, and exchanging experiences within niche communities. This highlights the importance of user-generated content platforms.

Online Shopping

- Walmart leads in the online shopping category, reflecting Americans' trust in large retailers with diverse product offerings and fast delivery.

Financial Services

- Cash App: Among the top apps for money transfers and digital payments, showing stable demand for simple and fast financial solutions.

Artificial Intelligence

- ChatGPT: Represents the AI app category, highlighting growing interest in artificial intelligence for work, learning, and entertainment.

Success in the U.S. market in 2024 will require:

- Focus on Branding: Strengthening app recognition and visibility.

- Optimization for User Needs: Addressing core demands like visual content, entertainment, and financial tools.

- Integration of AI Features: Leveraging cutting-edge technologies to create unique value propositions.

The U.S. continues to set global trends on Google Play, emphasizing the importance of innovation and adapting to the interests of different age groups.

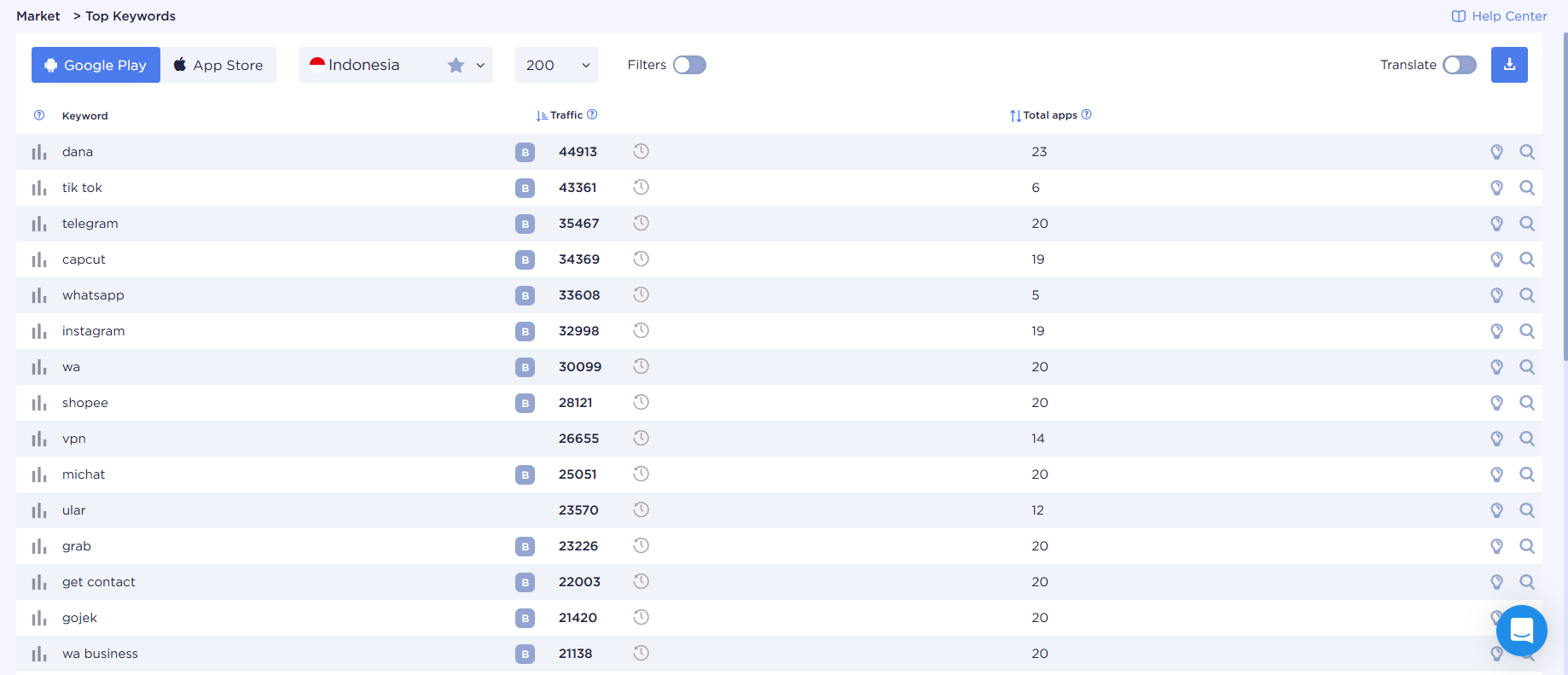

Indonesia: 95% Branded Queries and Unique User Preferences in 2024

In 2024, the Indonesian Google Play market displayed a 95% share of branded keywords among the top search queries. Only two non-branded queries, VPN and Ular, deviated from this trend, likely driven by quick searches using autocomplete rather than specific app categories. Interestingly, the query Ular leads to the app ULarCam, which integrates smart home solutions such as intelligent video systems, IoT devices, and Smart Home technology. This reflects a growing interest among Indonesians in smart home innovations.

The financial app Dana leads the list of queries, emphasizing the importance of digital payment services and online banking in users' daily lives. As in many other markets, Indonesians actively use social platforms and messengers: TikTok, Instagram, Telegram, and WhatsApp (including WA Business) highlight a strong interest in social interaction and visual content. Where social media thrives, tools for content creation also flourish. CapCut stands out for its simple yet robust video editing features, particularly valued by TikTok and Instagram users.

GetContact is a unique app that helps block spam and identify callers. Its feature allowing users to see how a contact is saved on other devices (e.g., “spam” or “don’t pick up”) makes it especially useful for combating unwanted calls. MiChat combines social networking and messaging functionalities, offering a convenient format for communication. This appeals to the Indonesian audience, which prefers versatile solutions.

Indonesians heavily rely on apps for daily mobility. Grab leads in the taxi and delivery segment, offering convenient transportation solutions. Gojek is a rapidly growing multiservice platform, providing solutions from food delivery to trip planning. This demonstrates a strong interest in apps that save time and simplify household tasks.

Shopee remains the leader in the e-commerce segment, offering users access to a wide range of products and an easy shopping experience.

To succeed in the Indonesian market, optimize for branded search by focusing on popular keywords and building a strong app brand. Highlight functional versatility to cater to users’ preference for apps that address multiple needs. Incorporate innovations, emphasizing smart technologies, security, and time-saving features.

In 2024, Indonesia demonstrates active growth in both traditional categories (social media, finance, transportation) and innovative areas such as smart homes and multi-purpose apps. This creates abundant opportunities for app growth and promotion in this vibrant market.

Popular Keywords as ASO Strategy

Brands dominate searches. Analyzing key queries from 2023 and 2024 reveals that branding is the key to success on Google Play. Over 90% of searches include specific app names, and brand recognition directly impacts search visibility and, consequently, app success. Developers should invest in branding by creating a strong name and clear visual identity for their apps. Marketing efforts outside the app store, such as on social media, through influencers, and in advertising campaigns, should also be prioritized to strengthen positions in branded searches.

User needs remain universal. Despite global changes and crises, user search queries continue to revolve around essential areas of life such as social interaction, financial control, shopping and delivery, entertainment and gaming, and transportation and multifunctionality. To succeed, developers should focus on addressing specific everyday user needs. Narrow but highly useful app features significantly enhance popularity and chances of successful promotion.

Conciseness and clarity in keywords are critical. Modern users prefer short, precise keywords that immediately convey the app’s functionality. Queries like VPN, Train, CapCut, or ChatGPT emphasize the importance of brevity and accuracy. Developers should use simple and understandable keywords. The app name should be recognizable and functionally relevant, while metadata should be simplified with a clear title, concise description containing keywords, and visually appealing icons.

Artificial intelligence and multifunctionality are trends of the future. The growing popularity of AI apps such as ChatGPT and multiservice platforms like Gojek and ULarCam shows that users increasingly prefer innovative and versatile solutions. Developers should integrate AI technologies and develop multifunctionality in their apps to meet multiple user needs simultaneously.

Previously, success depended on functionality, but now recognition equals success. Branded keywords dominate, and users search for simple, concise, and functional solutions. For successful promotion on Google Play, developers must focus on branding, simplify keywords and metadata, solve specific user tasks, and follow trends like AI, multiservice solutions, and practical functionality. While 2024 did not bring dramatic changes, it confirmed one key truth: a strong brand and effective ASO remain the most important tools for growth and audience retention.

Українська

Українська  Русский

Русский  Español

Español