Mobile app market 2023 - report

Traditional report on the mobile app market for the past year, 2023. What's new in the App Store and Google Play categories, Tops, mobile games and what's happening with downloads and income. And of course, we’ll talk about the features of market development, the competitive environment, artificial intelligence and predict what to expect from 2024.

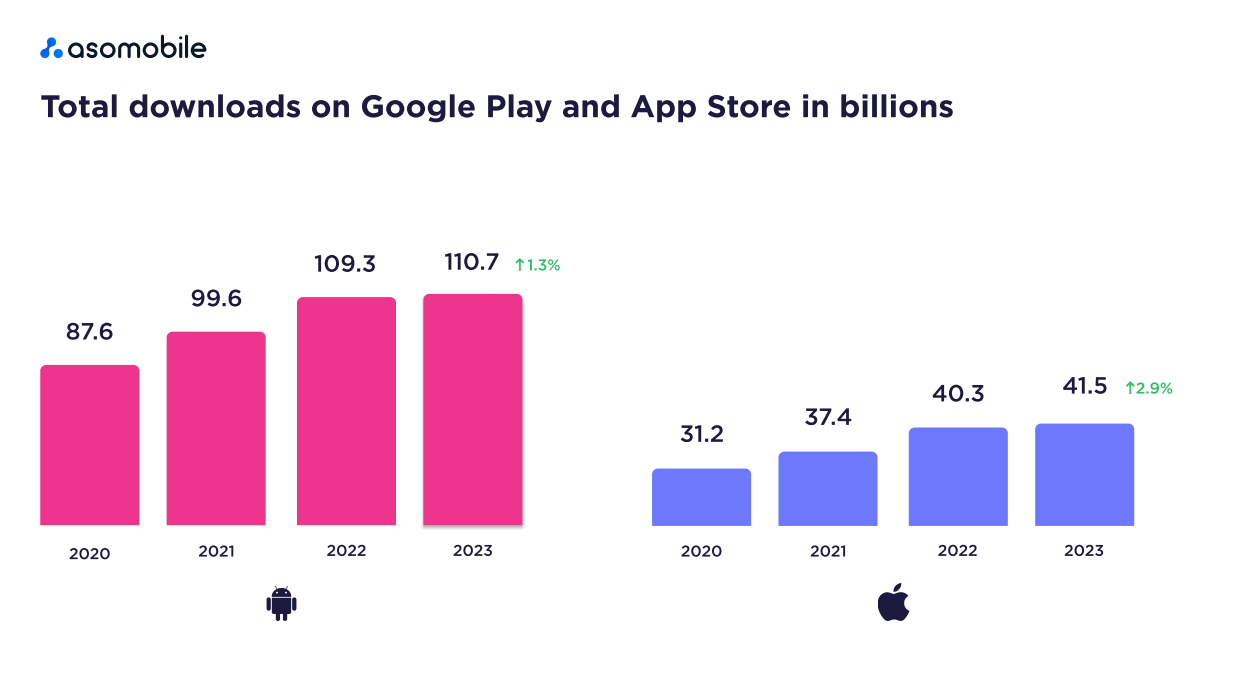

Total iOS & Android Downloads 2023

Every year we see an increase in app installations, but it is getting slower. And if the pandemic years showed us sharp jumps and incredible results, now we can count on a moderate increase in the number of downloads. The market is becoming saturated, users are becoming more demanding, and quantity is gradually turning into an indicator of quality. We end 2023 with 110 billion installations on Google Play and 41.5 billion on the App Store. Traditionally, the Android sector has demonstrated dominance in the number of game and app installations. Not surprisingly, according to Statista, Android maintained its position as the world's leading mobile operating system in the fourth quarter of 2023 with a 70.1% market share. Android's closest competitor, Apple's iOS, held a market share of 29.2% during the same period.

TOP applications by downloads on Google Play & App Store

By default, Instagram is included in the top 10 applications. For Google Play it remained in first place (like the previous three years), but on the App Store it “slipped” to third place. WhatsApp messenger, for the third year in a row, is only slightly inferior to Instagram in terms of installations for Android. On the App Store, it lost a little position from fourth to sixth place.

Among the new products in the Top Ten of Google Play is the Shein shopping application, which suddenly found itself in eighth place. There are also shopping lovers among iOS users; there, right in fifth place, out of nowhere, the Temu application appeared - the unicorn of 2023 among apps.

Among those who left the Top, it is worth mentioning Spotify, which could not withstand the competition and fell out of the top ten.

Now let's move on from downloads to a more pressing topic - what about revenue?

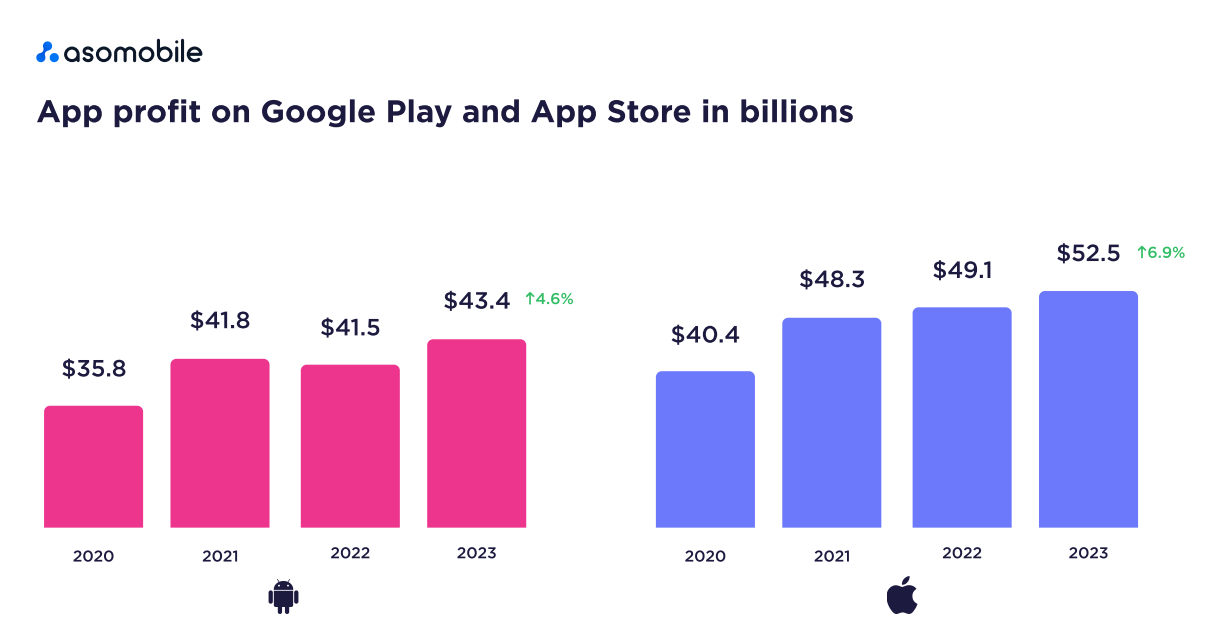

Revenue of Google Play & App Store applications

On a positive note, after last year’s decline, the application market shook itself off and showed excellent positive dynamics. This is especially true for the Android market, because it was it that demonstrated a drawdown in income, which served as warning lights for many, because the specter of a crisis was already more than real. So for 2023, Google Play got +4.6%, the App Store (traditionally overtaking its competitor), finished the year with +6.9%. This is certainly not a jump from 2021, when the market showed almost 20% growth, but stable growth allows us to speak more confidently about the prospects.

Who was the reason for such positive dynamics - applications that showed a confident level of revenue look like this.

Subscription to Google One remains not only one of the popular applications, but also the most profitable; for the second year now, it has been leading the Google Play Top in terms of revenue, pushing the Coin Master game in 2022. We think that every reader who uses Android will find expanded storage space in their subscriptions, and most likely it will be Google One.

For the App Store, YouTube turned out to be the most profitable (both for the store and for the developer). Although the word turned out to imply at least some kind of surprise effect, this is clearly not about this app, which has been confidently holding first place in terms of revenue since 2020. And no crises, pandemics or military conflicts could shake its monopoly on primacy.

TikTok rose to second place in terms of revenue, which is true for two markets at the same time. And Tinder, traditionally more popular for iOS users, unexpectedly appeared in the top 10 leaders on Google Play.

The games that were included in the Top slightly changed their positions among themselves, only Pokemon Go dropped out among Android and grabbed the last place on the App Store. Roblox and Candy Crush Saga traditionally interest users and bring good income to developers.

On a curious note, the app with manga comics Piccoma quickly broke into the top 10 of the App Store, immediately landing in 7th place, this is a stunning success.

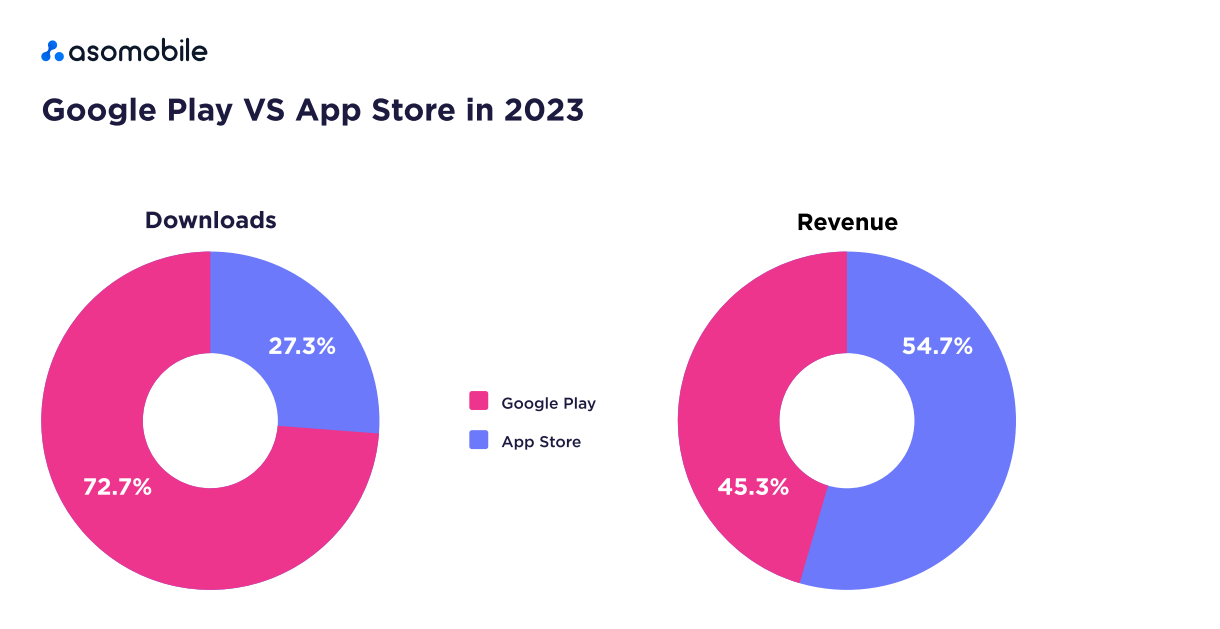

Google Play VS App Store downloads in 2023

The ratio of downloads between Google Play and the App Store is at a standard level and does not fluctuate significantly - from 73% to 27% to the current 72% to 28%. Still, the growth rate of installations on the App Store makes itself felt - it is growing faster than its Android counterpart. But income, traditionally the area of dominance of iOS applications, has undergone only minor changes - the App Store has grown slightly in this regard, only by tenths of a percent.

Let's now see what's happening in the Categories - who is in the Tops, what has changed since last year and what the situation is like on the two platforms.

Top categories by Google Play & App Store downloads 2023

Casual and Action hold the palm on Google Play and App Store, respectively. Among the Android market, Simulation was moved to third place, behind the Entertainment segment (although how can you move a goat simulator? Is that possible?). By the way, the App Store confirms this - Simulation rose to third place, displacing Arcade. Photo & Video modestly ranks second among iOS applications in terms of downloads.

When what is established is clear, it’s time to move on to the question - how much is it in money? And do users’ tastes coincide in the desire to install and the desire to pay for it?

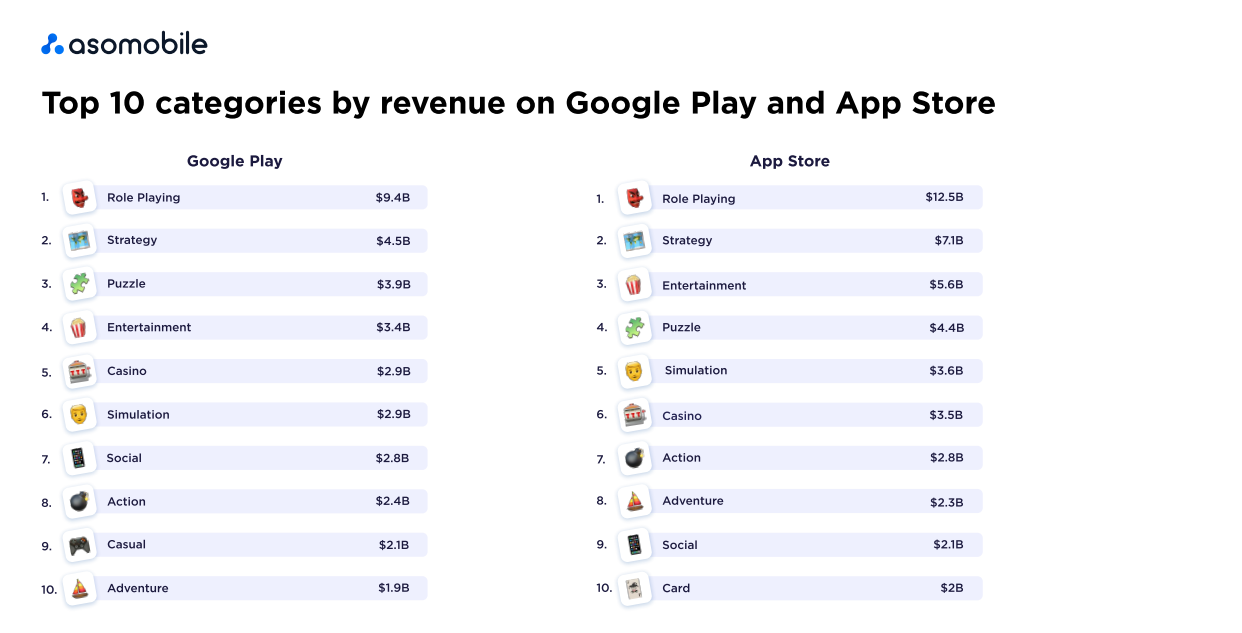

Top categories by revenue Google Play & App Store 2023

The situation with downloads and income is radically different. From the top of the Tops, only the Entertainment category can boast positions close to the leading ones (on Google Play it is 4th place, and on the App Store it is 3rd). For the two stores, Role Playing and Strategy games are rightfully in the lead, which have continued this tradition for many years and confirm their leading role among the holy war - mobile applications vs mobile games.

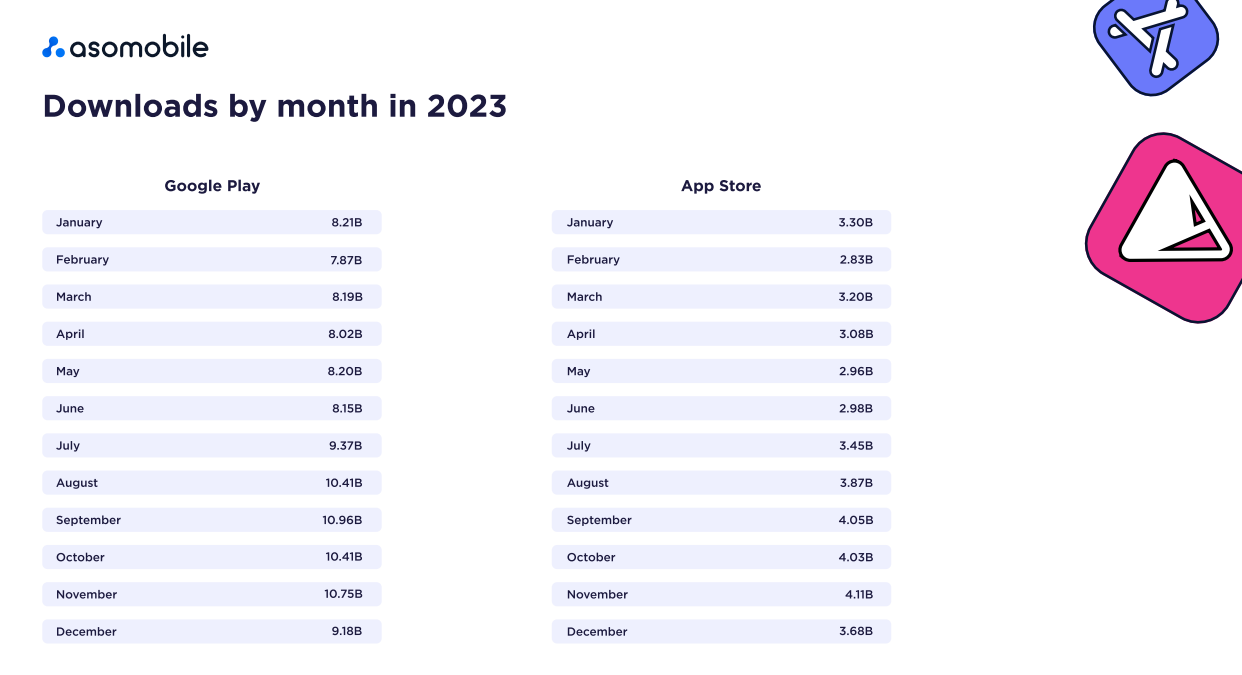

What about the calendar?

The busiest and most downloaded month for apps is September! And in general, all fall months can boast of top downloads. Either the weather is getting worse and there is time to “hang out on the phone,” or school time motivates users to install more. The situation with revenue is similar - October is the golden time not only according to the calendar, but also for developers.

Geography of revenues and downloads

India has become a Klondike for Google Play, both for apps and mobile games. This trend has been observed for several years in a row. Brazil and the USA also traditionally maintain leadership, changing each other from second to third place depending on the category - let it be games or apps. Germany is one of the newcomers to the top 10 countries in terms of downloads for Google Play, but only in the category of mobile games. Other countries out of 10 may change places, but continue to be active participants.

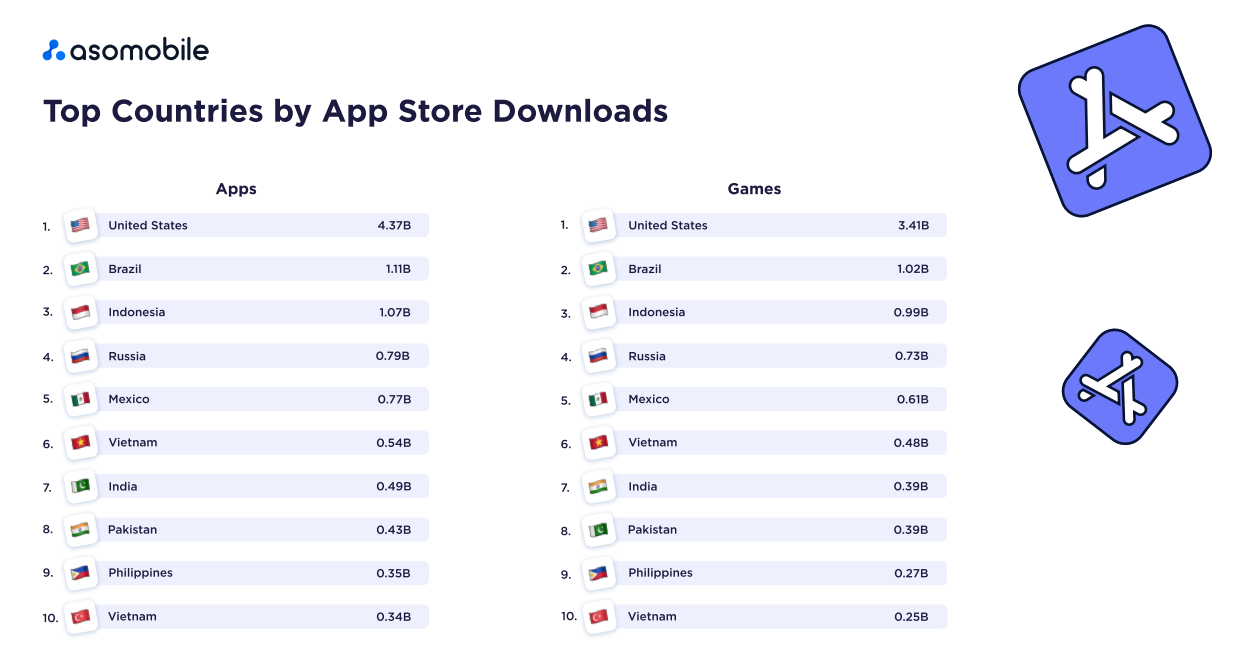

As for the situation in the App Store, the leading countries in terms of installations are as follows:

The USA annually tops this ranking in two categories - surprising no one, since this is a market conquered by the iOS platform. But Brazil has surpassed Indonesia and now flaunts in second place, both in applications and in games. Japan left the top ten, giving way to Turkey, which is true for both categories.

Revenue by country on Google Play & App Store in 2023

In the Top countries by revenue among apps, there is little news - everyone remained in their places with the exception of Italy, which “left the chat”, giving way to Canada (which immediately flew into 6th place). In the games category, Italy did better - it supplanted Saudi Arabia and took 10th place in terms of installations.

The sources of revenue for the App Store are the participants already known to us. The US leads across all categories and platforms. Japan also keeps up and has been firmly in second place for several years in a row. From the reshuffles and updates, we can see a completely similar composition and placement of participating countries in the application category. But in the games a player was replaced - Saudi Arabia appeared on the field, displacing Italy. Perhaps they made an exchange - Google Play for some, and App Store for others?

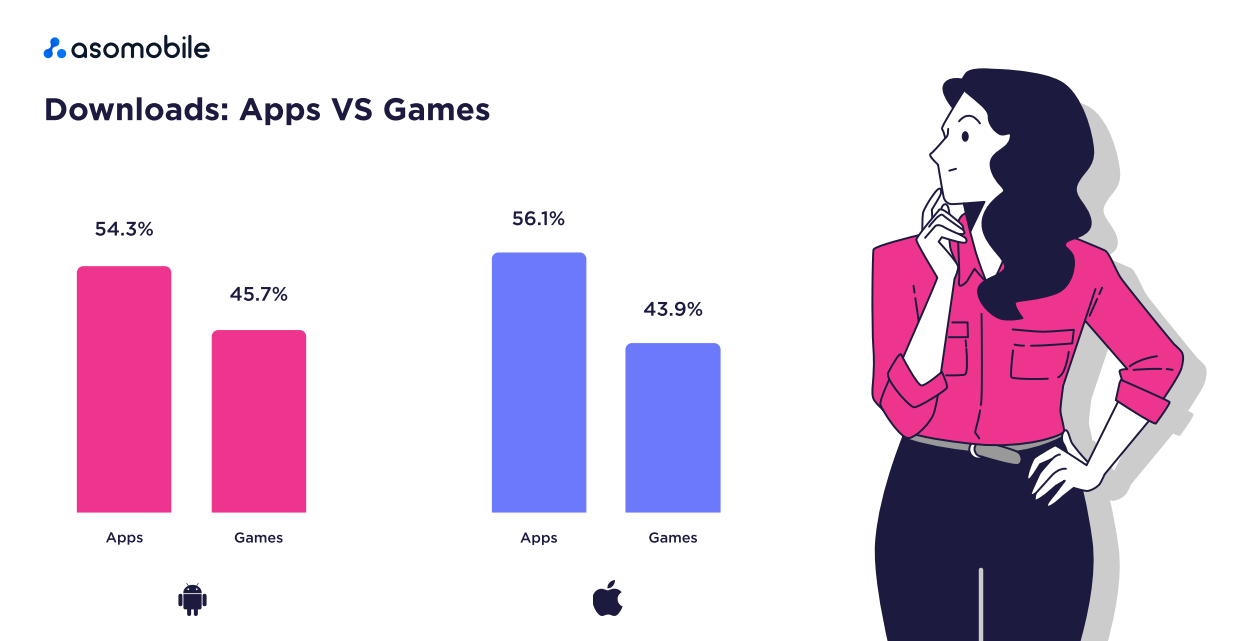

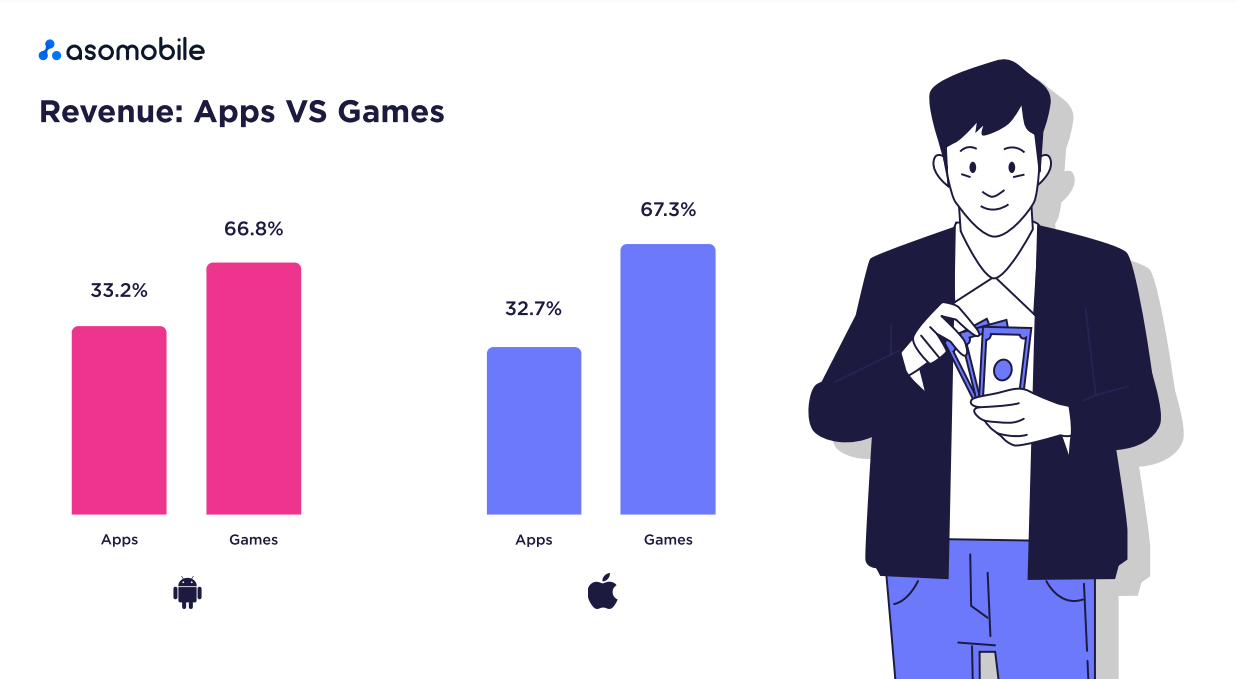

Applications VS Games

In terms of downloads, the situation has been constantly changing since the formation of the mobile app market - last year showed us the dominance of mobile games, while this year pleases with a similar proportion, but with opposite results. Applications took over the majority of installations, both for the App Store and Google Play.

As for revenues, there are no surprises - mobile games continue to be the main category with higher profit margins for developers. The distribution between games vs apps tilted even more in favor of the former this year.

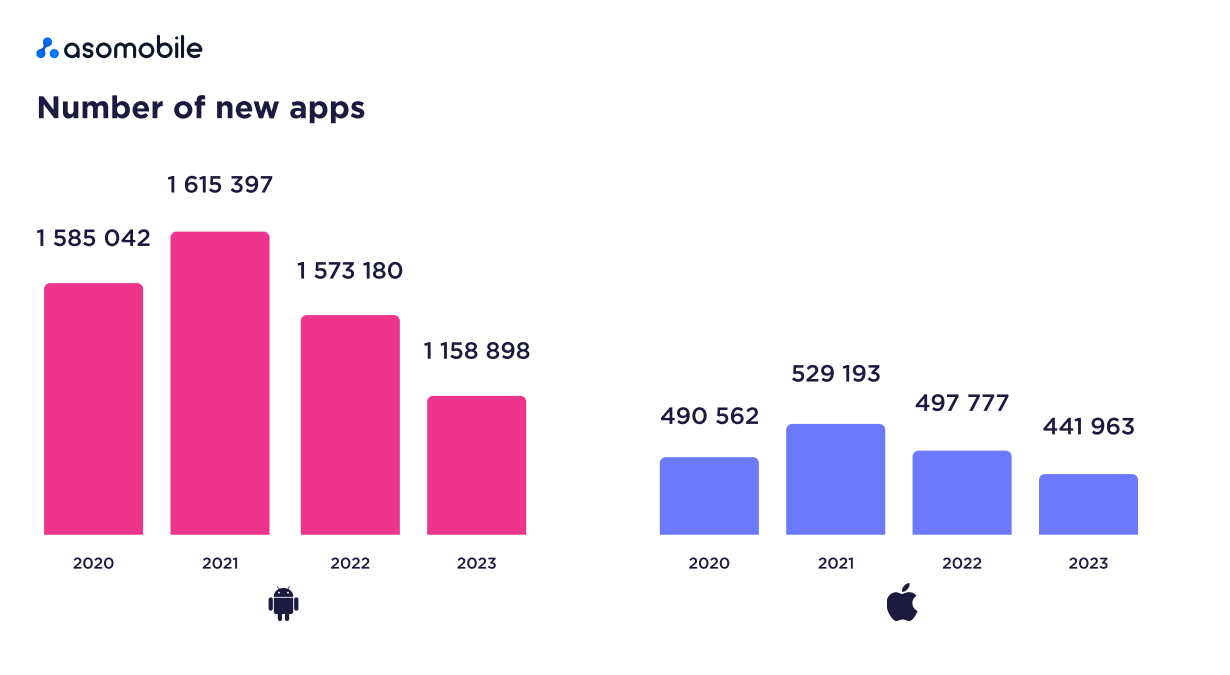

New apps of 2023

The number of new apps has been declining for the second year in a row, which rather indicates a normal situation on the market after the abnormal surge in 2021. The market is becoming saturated, very competitive, niches are being filled and the entry barrier for new developers is quite high. But the beauty of the mobile application market is that it is difficult to predict what exactly users will react to among the new products and it is easy to turn from a novice application into a unicorn. This market can easily be called a market without borders.

Mobile app market 2023 and forecasts for 2024

Trends on Google Play and App Store in 2023: Quality above all

In 2023, the desire for app quality has come to the forefront due to market saturation. Developers have to focus on creating unique and high-quality products to stand out from the competition.

Despite the decline in the number of new applications, revenue from mobile applications remained at a high level, which indicates a consistently high user interest in mobile content.

The App Store continues to lead in revenue, but Google Play has a significant market share. This highlights the importance of developing and promoting apps for both platforms.

Social networks and instant messengers dominate the market, emphasizing the importance of social interaction in applications.

App store search remains the primary channel for app discovery, making ASO a key path for user acquisition.

Interesting Facts:

- Users spend 88% of their time in apps, reducing time spent on calls to 12%.

- Once an app is installed, user retention rates drop significantly within just a few days, making retention strategies critical.

The use of AI in application development is becoming commonplace, improving processes and increasing the quality of products.

Monetization and the role of AI:

A 12% increase in consumer spending and in-app purchases in the US confirms that users are willing to pay for quality content. A variety of monetization strategies help meet these needs.

AI has impacted the entire mobile app market, increasing the number of downloads of AI apps by nine times. Among them, photo and video editors are the most popular.

Let’s take a quick glimpse into the future:

- The mobile market is expected to grow due to increased access to the Internet and smartphones.

- Users are increasingly demanding about the quality of applications, which raises development standards.

- Subscriptions and in-app purchases remain the main sources of revenue.

- Personalization and AI are becoming the key to success in improving user experience.

- There is growing interest in niche and health and wellness apps.

- Data privacy remains a focus, requiring apps to comply with regulations.

The mobile app market in 2024 will require developers to be flexible and innovative to meet rapidly changing trends and user needs.

Download the full report.

Українська

Українська  Русский

Русский  Español

Español