Social Mobile App Category – Analysis and Forecasts for 2025

The Social category in mobile applications consists of apps that maintain consistently high user engagement and can rightfully be considered one of the core pillars of the mobile ecosystem. Previously, we analyzed the Finance and Utility app categories - now, let’s take a closer look at Social apps.

This category encompasses all mobile applications for communication, content creation, and community interaction. It includes traditional social networks, messaging platforms, live streaming services, and specialized niche platforms.

- Social Networks

Apps where users can share content, follow news updates, subscribe to pages, and maintain personal blogs.

Examples: Facebook, Instagram, X (Twitter), TikTok, LinkedIn, Reddit

- Messaging and Communication Platforms

Apps facilitating text messaging and voice and video calls, including private and group chats.

Examples: WhatsApp, Telegram, Messenger, WeChat, Discord, Signal, Viber

- Dating Apps

Platforms are designed to help users find potential partners or establish new connections.

Examples: Tinder, Bumble, Badoo, Hinge, OkCupid

Live Streaming and Video Broadcasting Apps

Services where users can host live broadcasts, watch streams, and engage with audiences in real time.

Examples: Twitch, YouTube Live, Facebook Live, Bigo Live

Creative and Content Platforms

Apps enabling users to produce and distribute content, including short videos, podcasts, and written articles.

Examples: TikTok, Snapchat, BeReal, Clubhouse, Patreon, OnlyFans

- Forums and Community Platforms

Apps where users can discuss topics of interest, ask questions, and share experiences.

Examples: Reddit, Quora, Amino, Stack Overflow

- Virtual Worlds and Metaverse Platforms

Apps that facilitate social interaction in virtual environments, integrating VR/AR technologies.

Examples: Horizon Worlds, ZEPETO, IMVU, Rec Room

How is the Social Mobile App Market Evolving?

The Social app landscape is undergoing significant transformations. It is no longer limited to simple messaging and networking. Instead, these platforms are evolving into multifunctional ecosystems, integrating e-commerce, AI-driven features, and financial tools such as donations, in-app purchases, and subscription models. The intersection of social media, digital finance, and artificial intelligence is shaping the next phase of the industry, making Social apps more immersive, monetizable, and essential to users’ daily digital experiences.

Social Mobile Apps in 2024: Trends and Market Dynamics

According to a recent Data.ai report, the global popularity of social apps shows no signs of slowing down—users continue to spend a significant amount of time on these platforms. By the end of 2024, the total time spent on social media apps exceeded 600 billion hours per quarter.

One of the most notable growth markets has been India, where engagement with social media has more than doubled since 2021. However, messaging app usage has remained relatively stable, indicating a shift in user focus toward content-driven platforms.

In developed markets, social networks are starting to encounter market saturation. Some users consciously reduce their screen time, leading to a slight decline in activity in the U.S. and the U.K. in 2024. Despite this, social media remains deeply embedded in daily life:

- The average American spends 90 minutes per day on social apps.

- The average Brit spends 85 minutes per day.

A Turning Point for User Behavior?

Could this indicate a global shift in user habits? It’s too early to tell. While the category may not post record-breaking growth rates, it continues demonstrating stable and sustained expansion.

Social apps ranked fourth among all app categories in total downloads, with 2.4 billion installs in 2024. This confirms their enduring relevance in an evolving mobile landscape.

The ranking of the most profitable app categories in 2024 reflects the evolving dynamics of the mobile market. Social apps secured the 8th position, generating over $1.8 billion in revenue.

While social platforms continue to dominate user engagement, their monetization strategies - such as subscriptions, in-app purchases, and virtual gifts - are still catching up with top-grossing categories like gaming, entertainment, and productivity apps.

Despite this, the Social category maintains a steady revenue stream, proving that social engagement remains a key driver of in-app spending.

Social platforms are actively transforming their monetization strategies. While advertising has traditionally been the primary revenue source, the landscape is evolving. Inspired by TikTok’s success with in-app purchases (IAPs), major platforms like Instagram and Snapchat have integrated their own IAP models, adapting to new market demands and the shifting digital advertising environment.

As a result, total in-app purchase revenue in the Social category reached $13 billion in 2024, marking a 27.5% year-over-year increase.

By the end of 2024, TikTok emerged as the most profitable non-gaming app, generating over $2.5 billion in revenue. This underscores the platform’s dominance in driving direct consumer spending through virtual gifts, subscriptions, and premium content.

Despite the competitive landscape, demand for Social apps remains strong, and industry shifts create opportunities for new players. The transformation of X (formerly Twitter) under Elon Musk’s ownership has reshaped the microblogging space, opening the door for emerging platforms looking to capitalize on evolving user preferences.

ASO Optimization Strategies for Social Apps

The steady growth in user and developer interest in Social applications has led to increased competition in the App Store and Google Play. As a result, ASO strategies must be highly refined, ensuring metadata is strategically optimized while visual assets stand out in a crowded marketplace.

Benchmark Data: Conversion Metrics for Social Apps (Q4 2024)

To craft an effective ASO strategy, it's crucial to analyze industry benchmarks, particularly the conversion rates at different stages of the app discovery funnel. Below are the key performance metrics for Google Play and the App Store based on data from the last three months of 2024:

- Google Play:

- Page View to Install Rate: 33.38% (One-third of users install after viewing the app page)

- App Store:

- Impression to Page View Rate: 2.3% (Only a tiny fraction of users visit the app page after seeing it in search or browse results)

- Page View to Install Rate: 66.61% (Two-thirds of those who visit the app page proceed to install)

- Impression to Install Rate: 1.53%

Key Insights for ASO Strategy

Google Play Behavior:

Around 33% of users install after visiting the app page, highlighting the importance of optimized store listing pages (icon, screenshots, description, and video previews). Keyword optimization and ranking in relevant search queries remain critical for visibility.

App Store Behavior:

The low Impression-to-Page View rate (2.3%) indicates that users often install directly from search results without opening the app page.

However, once users visit the app page, the Page View-to-Install rate is over 66%, suggesting that those who engage with the listing are highly likely to convert. This behavior implies that users search for specific apps or well-known brands rather than casually browsing for new social networks or messaging platforms.

With competition intensifying, standing out visually and optimizing metadata is crucial for Social apps looking to maximize visibility and downloads in 2025.

Text ASO Strategies for Social Mobile Apps

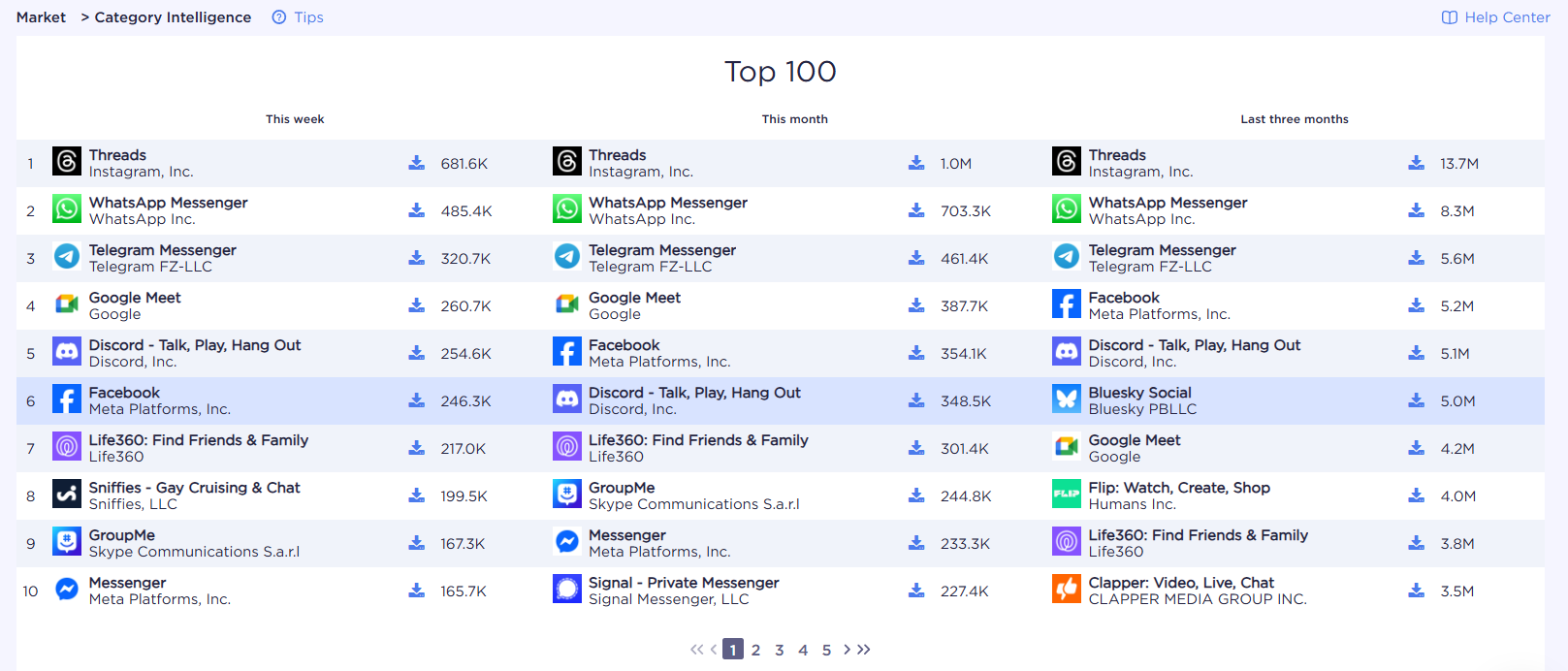

Analyzing the Top 100 Social Apps in the U.S. market over the last three months of 2024 reveals key trends in text-based ASO. Understanding these patterns can help developers refine their keyword strategies and metadata to maximize visibility and conversion.

The market leaders - the "dinosaurs" of the social media space - can afford minimalist branding without additional keywords in their app names. Apps like X, Instagram, and Messenger rely purely on their brand recognition, eliminating the need for descriptive keyword optimization.

However, lesser-known apps must take a different approach. They typically expand their app titles by combining brand identity with high-value keywords to improve visibility and user discovery. These keywords often directly reflect the app’s core function, such as communication, chat, messaging, or dating.

ASO Best Practices: Balancing Brand and Keywords

Established Brands (High Awareness, Minimal ASO Focus on Keywords)

- Examples: X, Instagram, Messenger, TikTok

- These apps don’t need keyword-heavy titles since users search for them by name.

Growing or Mid-Tier Social Apps (Brand + Descriptive Keywords)

- Examples: Discord – Chat, Talk & Hang Out, Tinder – Dating & Meet People

- These apps enhance discoverability by adding function-oriented keywords alongside the brand name.

New or Niche Apps (Brand + Strong Keyword Optimization)

- Examples: Hinge – Dating & Relationships, BeReal. Your Friends for Real

- These apps integrate a mix of brand identity, core functionality, and unique selling points into their metadata.

Visual Optimization for Social Mobile Apps: Trends & Key Insights

The app icon is the first visual element users see in the App Store and Google Play, making it a critical factor in branding, recognition, and click-through rates (CTR). An effective icon design for social apps reinforces brand identity while ensuring maximum visibility in search results and category rankings.

Bright, High-Contrast Colors

Social apps often use vibrant, saturated colors to make their icons stand out in search results. Examples: Instagram → Gradient pink & purple; TikTok → Neon accent on black; Snapchat → Bright yellow

Minimalism & Clean Geometry

Simple shapes and clean lines improve icon clarity and recognizability across different screen sizes. Examples: Facebook → "F" on a blue background; Telegram → White rocket on a blue background

Unique Symbols & Logos

Strong branding relies on distinctive, instantly recognizable symbols. Examples: TikTok → Musical note; Pinterest → Letter "P" in a circle; YouTube → Play button

Gradients & Shadows for Depth

Modern icons often incorporate subtle gradients and soft shadows to create depth without clutter.

No Text in Icons

The best-performing icons avoid text, focusing on symbols instead. The exception is Threads, which integrates the letter "T" into its design.

Why an Optimized Icon Matters

- Higher CTR → A more noticeable icon attracts more clicks in the app store

- Stronger Branding → Users recognize and remember the app faster

- Competitive Advantage → Helps the app stand out from similar platforms

Screenshots are among the most influential visual ASO components, directly impacting conversion rates and user engagement. In the highly competitive Social category, screenshots must be dynamic, visually striking, and content-driven to showcase the app’s core features and value proposition effectively.

Focus on Key Features

Each app highlights its core features that make it unique.

- Instagram and Facebook emphasize Stories, Reels, and interactive features.

- TikTok showcases short videos, content personalization, and recommendations.

- WhatsApp focuses on simplicity and secure communication.

Bright ShadeAccents

High-contrast backgrounds that match the app’s brand colors are used.

- Instagram applies purple-pink gradients.

- TikTok combines a black background with bold red, turquoise, and white accents.

- WhatsApp stands out with minimalism – a clean green background and a simple design.

Short but Informative Text Descriptions

Screenshots include concise slogans explaining the app’s key features.

- TikTok uses phrases like "Get in the Game".

- WhatsApp features "Simple. Reliable. Private.".

These help users quickly grasp key benefits without reading long descriptions.

Showcasing the App’s Interface

All screenshots include UI elements, allowing users to visualize the app’s experience post-installation.

- Instagram displays Reels and chat screens.

- Facebook highlights the news feed and video content.

Optimized for Vertical Format

Most social apps use portrait (vertical) screenshots, as they are best suited for mobile viewing.

- The vertical format maximizes screen space and keeps users engaged.

How Screenshots Impact ASO Performance

- Increase CTR for the app page

- Quickly communicate the app’s value

- Highlight competitive strengths

- Create an emotional connection and drive installs

Social Mobile App Market: Summary & Forecast for 2025

What trends will shape the growth of this segment?

Social Apps: A Stable & Expanding Market

Social applications remain key players in the mobile app industry, demonstrating high user demand and steady growth. In 2024, the total time spent on social media surpassed 600 billion hours per quarter, with 2.4 billion downloads recorded.

Despite market saturation, interest in social platforms remains strong. Developing new interaction formats and integrating e-commerce, AI solutions, and in-app purchases (IAPs) allow social networks to unlock new revenue streams.

Market Saturation in Developed Countries & Expansion into New Regions

- The U.S. and U.K. are experiencing growth stagnation as users begin to limit their social media usage.

- In contrast, India and other emerging markets continue to see rising engagement levels.

- In 2025, the focus will shift toward audience expansion in untapped regions where market saturation has not yet been reached.

New Monetization Models

- Ad-based monetization has long been social networks' primary revenue source, but growing competition and regulatory changes are reducing its effectiveness.

- In 2024, in-app purchases (IAPs) surged by 27.5%, generating $13 billion in revenue for social platforms.

- This shift confirms the growing trend toward monetization via subscriptions, donations, exclusive content, and virtual goods.

- TikTok became the highest-earning non-gaming app, generating $2.5+ billion, inspiring platforms like Instagram and Snapchat to integrate new IAP mechanics.

Rising Competition & The Need for a Strong ASO Strategy

With more social apps entering the App Store and Google Play, competition for user attention is intensifying. This makes textual and visual ASO optimization a critical success factor:

- Google Play: 33.38% of users install an app after visiting its page.

- App Store: 66.61% of users who visit the app page proceed to download.

- This indicates that grabbing attention early (title, subtitle, icon) in the App Store is crucial, while in Google Play, the app page itself must be persuasive.

Visual Optimization as a Key Engagement Tool

- Icons → Minimalist, high-contrast, and easily recognizable.

- Screenshots → Bright, showcasing key features, with short CTA-driven slogans.

- Video Previews → These are increasingly used in ASO to boost conversion rates.

2025 Forecast

- Social media engagement will remain strong, but growth rates will slow in mature markets.

- Major expansion into Asia, Africa, and Latin America.

- Shift in monetization models → Subscriptions, donations, and virtual goods will gain importance.

- Rising competition will demand effective ASO strategies and adaptation to evolving app store algorithms.

- Social apps will transform into multifunctional platforms, integrating AI, e-commerce, and new interaction formats.

Conclusion

2025 will be a year of transformation for the Social category, where success will depend on brand recognition and the ability to adapt to new market realities.

Українська

Українська  Русский

Русский  Español

Español