Mobile Gaming Market 2025: Trends and Forecasts

Regarding the mobile gaming market in 2025, numbers speak louder than words. That’s why we’ve compiled a comprehensive analysis based on data from leading analytics firms enriched with our insights and expert conclusions. In this article, you'll find a structured breakdown of key industry shifts that shape mobile game development in the coming year - from market dynamics to evolving user behavior. Let’s dive in!

Mobile Gaming Market Overview: Trends, Dynamics, and Users

By definition, a trend is a primary direction of change - essentially, the source of a river. A tendency, then, is its flow, while users, continuing the analogy, are the swimmers - or rowers, depending on how you see it. Let’s break down each component step by step.

The mobile gaming market continues its rapid growth, driven by several key trends. First, smartphones are becoming more affordable and powerful, with hardware capabilities now enabling game graphics and mechanics once exclusive to consoles and PCs. This has opened the mobile gaming world to millions of new users globally. Today, the largest mobile gaming audiences are in China, India, and the U.S., where the market is evolving exceptionally.

Second, technological advancements have transformed devices and significantly improved connectivity speeds. Expanding 4G and 5G networks has revolutionized multiplayer gaming by eliminating lag and ensuring faster content downloads. By 2028, the number of 5G subscriptions is projected to reach 7.7 billion, making mobile gaming even more seamless and accessible.

Another crucial factor is the growing dominance of free-to-play games monetized through in-app purchases. Developers increasingly offer games without upfront cost, focusing on monetization through customization options, premium content, and microtransactions. This approach attracts a broader audience and enables long-term user retention strategies.

Additionally, mobile games are becoming more intertwined with social media and esports. The ability to compete with friends, share achievements, and participate in tournaments enhances engagement, making gaming an integral part of everyday life.

While all these factors undoubtedly contribute to the bright future of mobile gaming, challenges remain. Privacy concerns, user data security, and government regulations over this lucrative industry could pose significant hurdles. Nonetheless, the market’s trajectory remains firmly on an upward path.

Mobile Gaming Trends in 2025

Among all mobile gaming segments, hyper-casual games stand out the most in 2025. Their popularity stems from simple mechanics, instant accessibility, short gameplay sessions, and ad-based monetization. A prime example is Block Blast, which consistently ranks top of the App Store and Google Play charts, proving that players value easy, engaging, and non-intrusive entertainment. Additionally, the demand for hyper-casual games is undeniable, as they continue to dominate the top-ranking keywords across both platforms.

Hyper-casual games may dominate in accessibility, but they are not the only booming segment. In recent years, in-app purchases (IAPs) have become the primary revenue stream for many developers. Modern mobile games offer players a wide range of upgrades, from character customization to level progression boosts. Titles like Candy Crush Saga and Roblox are clear examples of how successful this monetization strategy has become.

While hyper-casual games thrive on ad revenue, most mobile games generate income through in-app purchases and microtransactions. In virtual worlds, players can buy anything - from unlimited lives to powerful boosters - and the demand is only growing. Thanks to advanced devices, cutting-edge technologies, and lightning-fast 5G networks, mobile games now deliver immersive mechanics, expansive worlds, and compelling narratives at an unprecedented scale. Users are willing to spend, and developers have the content to sell - creating the perfect monetization balance.

Who Plays Mobile Games?

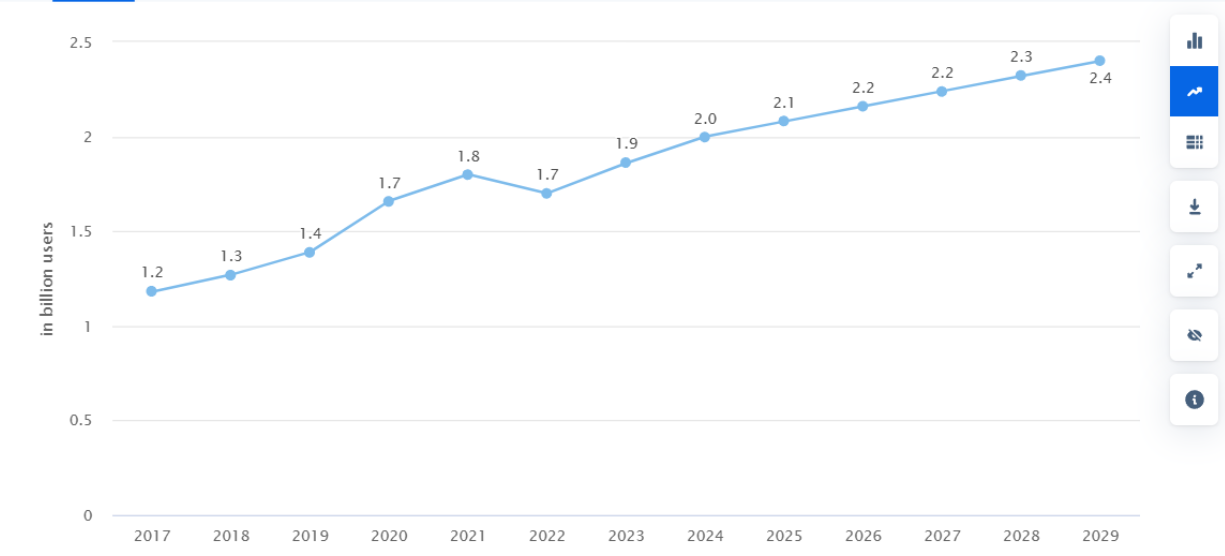

The number of mobile gamers continues to grow, and according to Statista, it is projected to reach 2.4 billion by 2029. At the same time, the average revenue per user (ARPU) is expected to increase from $60.58 in 2025 to $65.26 in 2029.

The key markets remain unchanged: the U.S. leads in revenue with $36 billion, while Asia and Europe play crucial roles in shaping the industry. Mobile games have long been an integral part of everyday culture in countries like Japan, Germany, and South Korea, with user engagement in these regions continuing to rise.

Moreover, mobile gaming is attracting an increasingly diverse audience. While teenagers and young adults were once the primary players, smartphones are now becoming gaming platforms for all age groups. More and more adults are turning to mobile gaming, with women and users over 35 becoming a significant demographic. This shift expands opportunities for developers and fuels the emergence of new game genres tailored to a broader audience.

Today's mobile gamers can best be described as a rapidly growing community. The transition of traditionally PC-exclusive games to mobile, the expanding variety of genres, and the increasing accessibility of technology continue to attract more players. As mobile gaming evolves, so does its audience, making it one of the industry's most dynamic and inclusive segments.

Top Games on Google Play

One striking trend in Google Play’s Free category is the dominance of hyper-casual games, which claim five out of the top ten spots. Among them is the previously mentioned standout, Block Blast, a prime example of the genre’s appeal. The remaining four include:

- Vita Mahjong – a classic "pair-matching" solitaire game

- Mini Games: Calm & Relax – a collection of engaging and relaxing mini-games

- Horror Spranky Beats – a lighthearted music-making experience with a horror twist

- Bus Frenzy: Traffic Jam – a puzzle game where players sort passengers by vehicle color

This level of representation is impressive for a single genre, proving once again that hyper-casual games continue to dominate mobile gaming trends.

Top Games on the App Store

In the Free category on the App Store, the hyper-casual Tetris-style game Block Blast! leads the rankings, while Vita Mahjong secures the second-to-last spot. Two ultra-simple games out of the top ten are impressive for the hyper-casual genre, especially on Apple's platform, which primarily focuses on revenue from in-app purchases and microtransactions rather than ad-based monetization.

To highlight this key market trend, we specifically analyzed the presence of hyper-casual games on both platforms. To illustrate the differences and similarities between the stores, we compared the top Free and Paid games on Android and iOS.

Key Similarities:

- Hyper-Casual Dominance – Block Blast! by Hungry Studio consistently ranks among the top free games on both platforms.

- Cross-Platform Hits – Popular games like Roblox, Squid Game: Unleashed, and Pokémon TCG Pocket perform well in the free categories of Google Play and the App Store.

- Card & Board Game Popularity – Titles like MONOPOLY, Balatro, Heads Up!, and Purple Place highlight the continued demand for paid board and card games.

- Simulation Game Trends – Farming and city-building games appear in both rankings (Township, Gardenscapes on Google Play; Animal Crossing: Pocket Camp, Stardew Valley on the App Store).

- No Paid Hyper-Casual Games – The Paid categories in both stores lack hyper-casual games, as their monetization model relies on ads—an approach more aligned with Google Play's revenue strategies.

Key Differences:

- Revenue & App Volume - The App Store generates more revenue, while Google Play hosts more apps.

- Monetization Focus:

- Google Play prioritizes ad-driven free-to-play models, leading to a more substantial hyper-casual presence (Block Blast!, Mini Games: Calm & Relax, Vita Mahjong, Bus Frenzy: Traffic Jam, Horror Spanky Beats).

- The App Store focuses on premium and complex games, relying on in-app purchases and paid apps, resulting in higher user revenue. The Paid category on iOS features roguelikes and strategy games (Balatro, Plague Inc., Bloons TD 6).

- Social Gaming:

- On Google Play, games like Cat Chaos: Prankster caters to quick and casual social interactions.

- On the App Store, multiplayer experiences, such as Minecraft: Play with Friends, tend to be more in-depth.

- Free-to-Play Behavior:

- Google Play’s top free games feature strong in-game economies and frequent microtransactions (Royal Match, Township, Roblox).

- The App Store’s free games (MONOPOLY GO!, Candy Crush Saga, Coin Master) emphasize habit-forming mechanics and aggressive monetization strategies to drive frequent app engagement.

This analysis reinforces a fundamental market distinction - Google Play dominates ad-driven casual games, while the App Store leads in premium and high-monetization titles.

2024 in Review & What to Expect in 2025

As noted in our 2024 report, the top-grossing games in 2023 were Candy Crush Saga, Honor of Kings, and Roblox.

According to Sensor Tower, in December 2024, the highest-earning mobile game worldwide was Last War: Survival, followed by Pokémon TCG Pocket in second place. MONOPOLY GO! secured third place with a slight gap, while Royal Match and Roblox rounded out the top five.

On Google Play, the biggest breakout hit of 2024 was Ludo King, with 15.47 million downloads. My Supermarket Simulator 3D came in second (14.19 million), while Roblox ranked third (11.24 million).

Meanwhile, Statista reported that 2024 MONOPOLY GO! generated over $1.58 billion globally, while the top-grossing game remained the Chinese MOBA Honor of Kings.

Market Insights: Established Hits vs. Aggressive Newcomers

From an analytical perspective, 2024 confirmed a key market trend:

- Top-performing games are either well-established titles with strong monetization models (Candy Crush Saga, Roblox, Honor of Kings),

- Or new games experiencing rapid growth due to aggressive acquisition strategies (Last War: Survival, Pokémon TCG Pocket).

App Store vs. Google Play: Monetization & Engagement Strategies

App Store: Strong Monetization & Event-Driven Retention

- The App Store favors games with powerful in-app monetization and event-driven engagement mechanics (MONOPOLY GO!, Royal Match, Pokémon TCG Pocket).

- Apple’s ecosystem prioritizes limited-time in-game events, encouraging frequent logins, increased resource spending, and higher in-app purchase conversions.

- These event mechanics help developers retain players, boost spending, and keep gameplay dynamic.

Google Play: Higher Downloads, Lower Monetization Per User

- Google Play sees more downloads, especially in hyper-casual and mid-core genres (Ludo King, My Supermarket Simulator 3D, Roblox).

- However, monetization strategies differ. The Android audience is more cautious about in-app purchases, meaning revenue distribution is less concentrated at the top.

- This highlights a fundamental platform difference:

- App Store: Higher player spending → Top-grossing games rely on progressive monetization.

- Google Play: More downloads, but monetization is less aggressive per user.

What’s Next in 2025?

Given these trends, 2025 will likely follow a similar pattern, with established hits maintaining dominance while newcomers with aggressive acquisition strategies shake up the rankings. Expect a continued focus on:

- Event-driven monetization (App Store) vs. high-volume downloads (Google Play).

- Mid-core expansion, where games balance accessibility and depth to drive engagement.

- Hyper-casual games maintain strong visibility in free categories but monetize primarily through ads.

The mobile gaming industry is more competitive than ever, but the formula for success remains clear: sustainable monetization models, engaging live ops strategies, and strong retention mechanics.

In the meantime, the search trends for January 2025 in the App Store (US) look like this:

ASO Strategy for Mobile Games in 2025

The evolution of mobile gaming is setting new standards for game promotion. In 2025, automation plays a key role in ASO. AI and machine learning are increasingly used to optimize ASO strategies, enabling developers to identify high-performing keywords and enhance content personalization.

Cross-platform compatibility is becoming another critical factor. Developers aim to expand beyond mobile to PC, consoles, and alternative app stores to maximize reach and revenue.

User retention remains just as important. Regular in-game events, seasonal promotions, and personalized offers help extend player engagement and boost Lifetime Value (LTV).

The mobile gaming market in 2025 continues to expand, offering players new mechanics and experiences.

- Google Play focuses on free-to-play models and ad monetization.

- The App Store prioritizes premium games and microtransactions.

Developers must adapt their ASO strategies to these platform-specific trends to stay competitive.

Українська

Українська  Русский

Русский  Español

Español