Mobile Gaming Market Report 2024. Forecast for 2025

This is our in-depth analysis of the mobile gaming market, part of our annual comprehensive report on the mobile app industry. Mobile games remain the most profitable segment of the app market, consistently attracting attention from developers, publishers, and investors. In our annual mobile market analysis, we explored the key trends that shaped the industry in 2024 and prepared forecasts for 2025. How did last year end? What challenges and opportunities does this year bring? Let’s find out.

The mobile gaming market keeps surging.

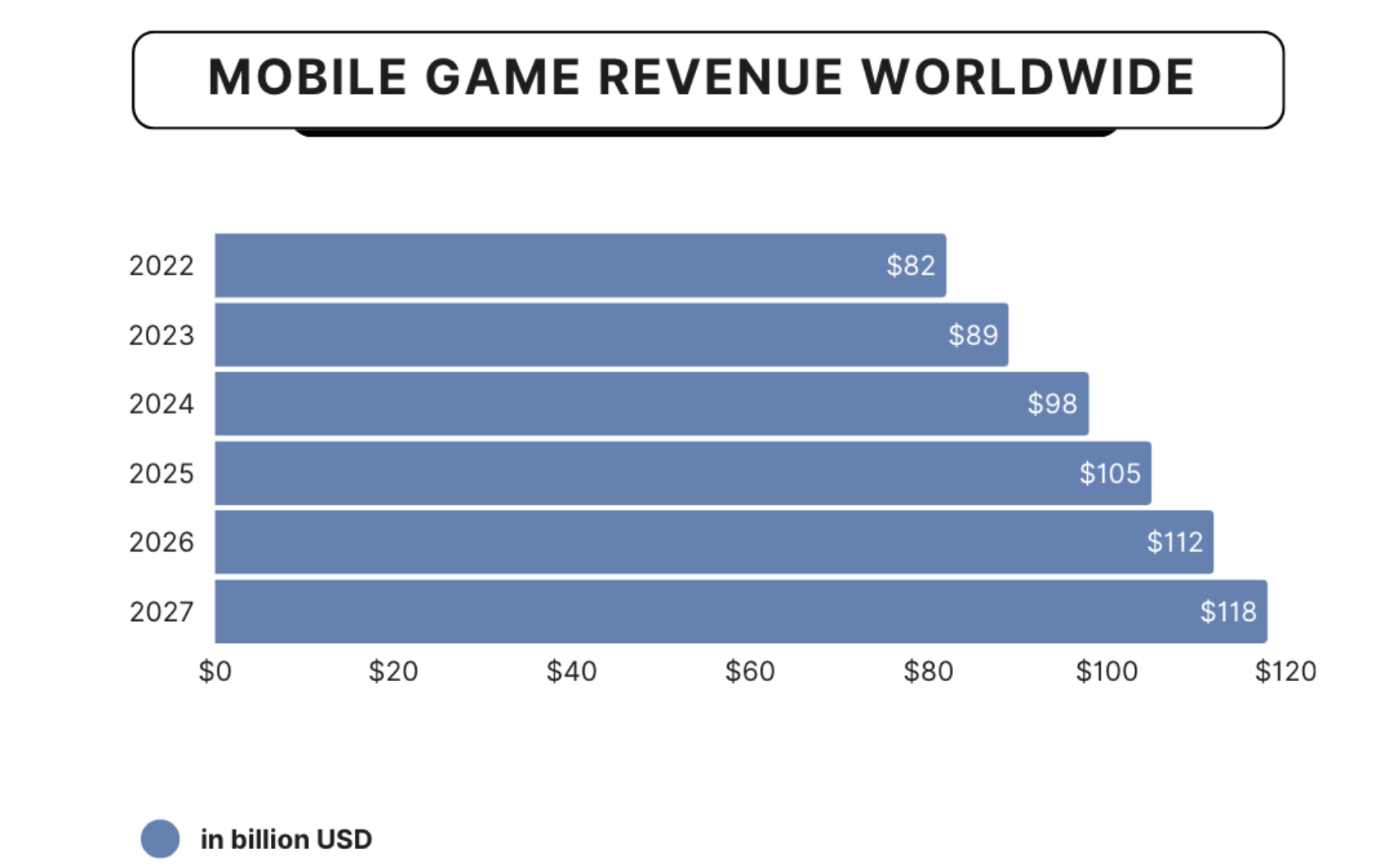

The mobile gaming market continues to grow rapidly, solidifying its dominant role in the industry. In 2025, mobile game revenue will reach $105.7 billion, growing to $118.9 billion by 2027. China will remain the largest market with $36.89 billion in revenue, and the global mobile gaming user base will hit 1.9 billion.

The role of mobile games in the app market

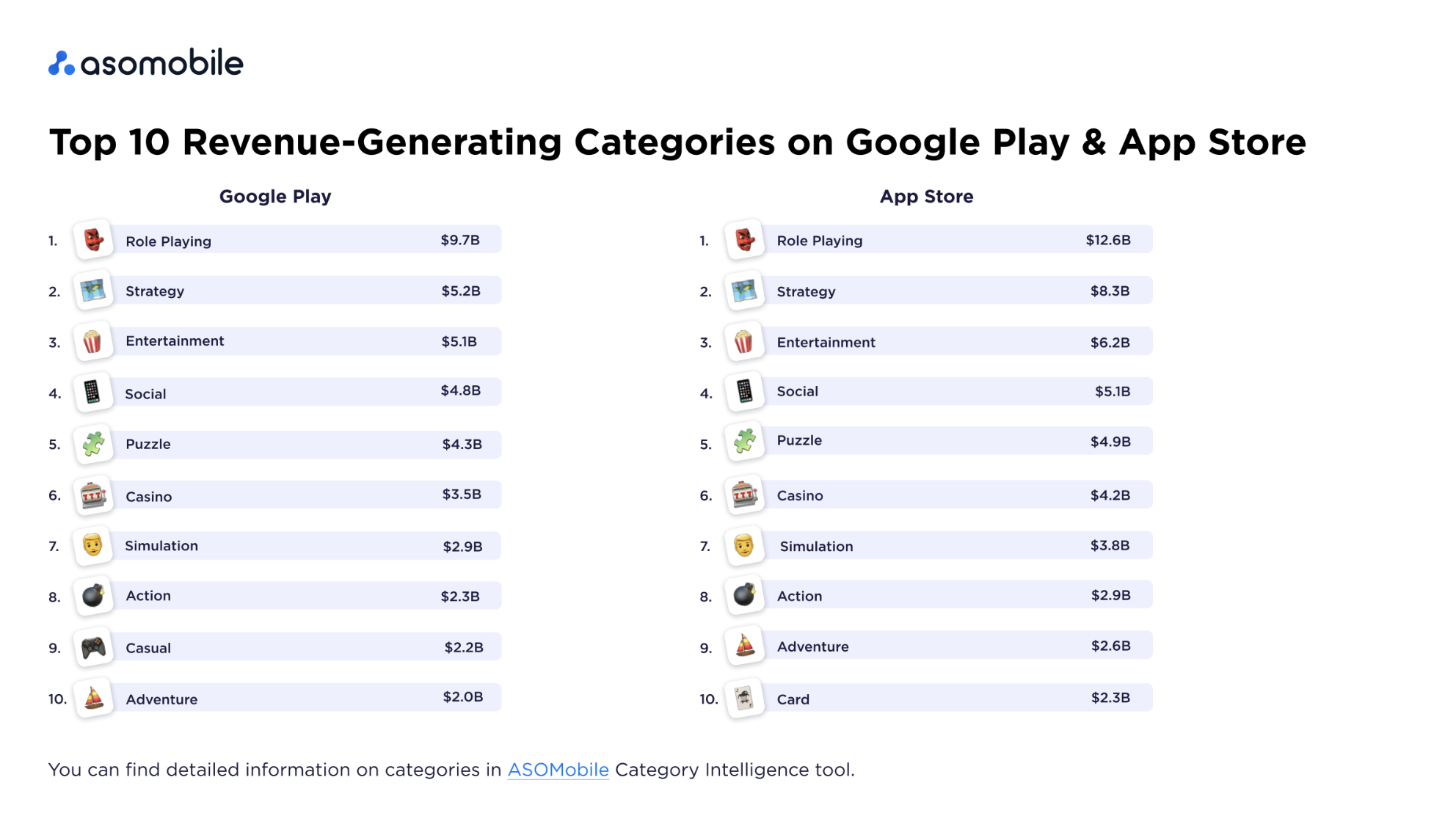

Looking at the top 10 revenue-generating apps on Google Play and the App Store, the picture is clear - mobile games account for more than half of all profitable apps on Android and just under half on iOS.

Among the categories most attractive to developers in terms of revenue, games not only lead the top 10 - they practically own it across both app stores.

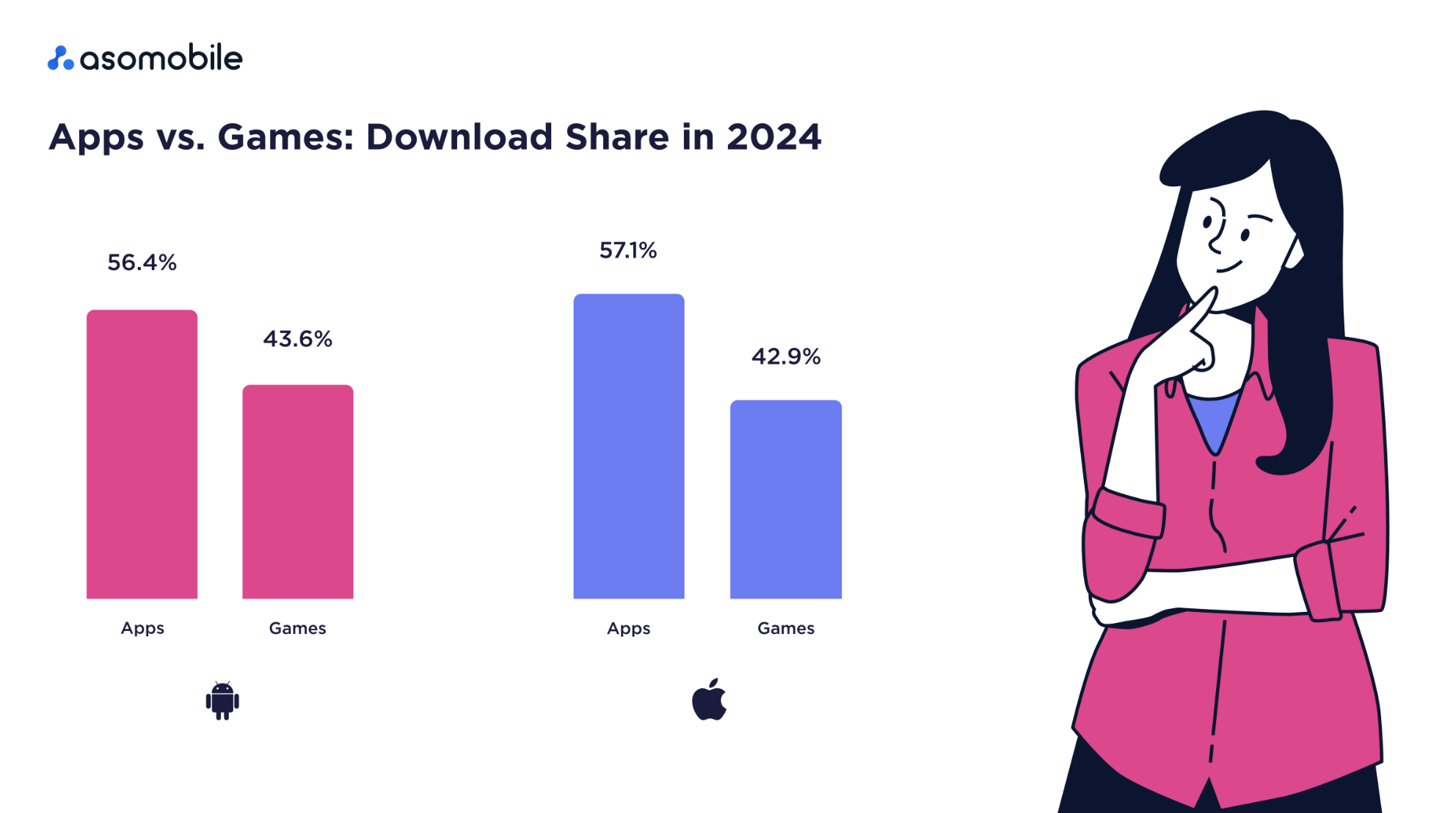

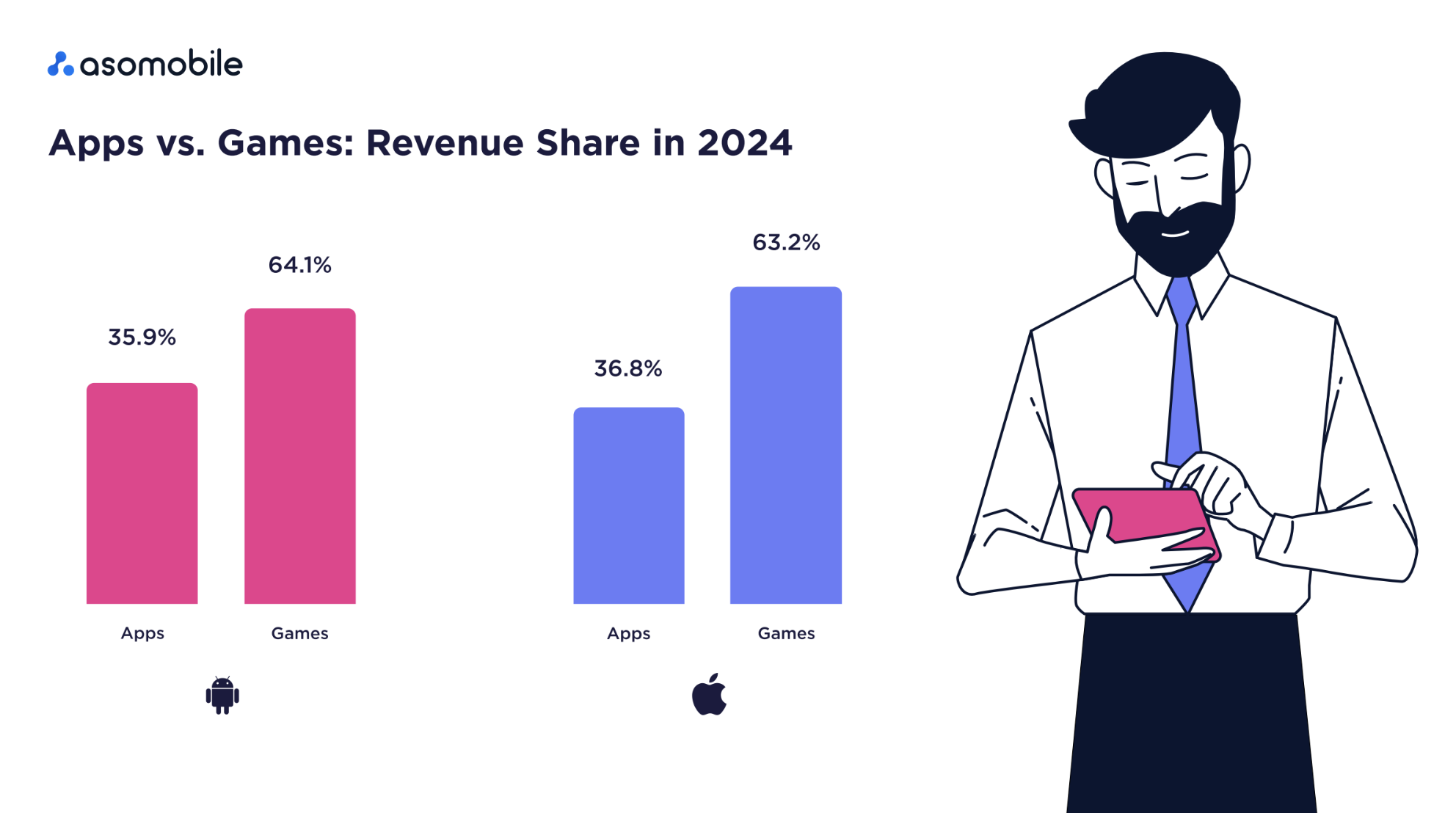

On both platforms, mobile games dominate category rankings. As for overall market trends, downloads are still higher for apps, but games remain the primary source of revenue:

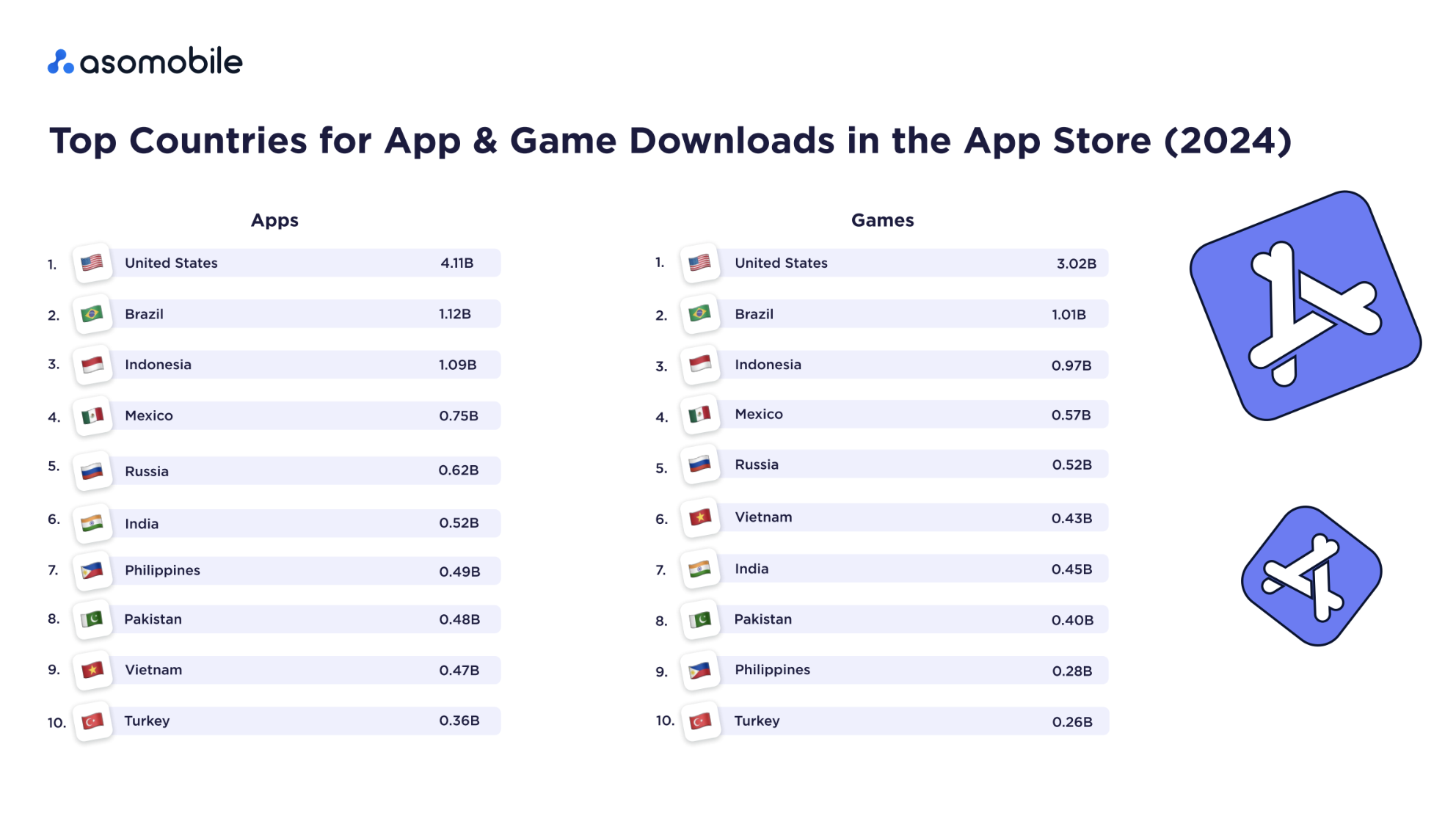

Geography of mobile game downloads

Google Play continues to show steady popularity for mobile game downloads in India. Brazil, however, has slipped from second to fourth place, overtaken by the US and Indonesia, now in third. The US ranking second is particularly interesting, as emerging markets typically serve as fertile ground for new breakout titles. While users in developing markets are still adopting smartphones, they tend to be less experienced and demanding than users in the US.

Regional platform preferences further mark this trend – Android dominates in India and Brazil, while the US is firmly in iOS territory. Let’s take a look at Apple’s mobile gaming landscape:

The picture is similar to Android – the US leads, followed by Brazil and Indonesia. Only Mexico moved up one spot. Although China is not included in the report, data from data.ai confirms iOS dominates the Chinese market and is second only to the US regarding downloads.

Geography of mobile game revenue

The US has again topped the charts in user spending on mobile games in the App Store and Google Play.

Japan remains a traditional stronghold of mobile gaming fans. South Korea and Germany complete the top 4 on Google Play.

The App Store revenue rankings are identical to last year's, confirming a trend - emerging markets are interested in downloads and potential, but the top spenders haven’t changed.

Top mobile game genres in 2024

According to Data.ai’s Mobile Gaming report, 2024 saw shifts in genre popularity:

Top genres by downloads

Simulation and Puzzle – each accounting for 20% of total downloads. Simulation games saw a +0.4% increase, while Puzzle games dropped by 3%. Arcade held 19% despite a -12.5% decline compared to the previous period. Lifestyle and Action categories took a sharper hit.

A surprise: Strategy games grew +14.5% in downloads. While they represent only 4% of total downloads, they account for 21.4% of total revenue. This genre is clearly “punching above its weight.”

Proven genres still dominate the market, but niche, highly monetizable segments like Strategy offer fresh growth opportunities. These game categories perform differently in various markets. Puzzle games in the US lead downloads, as in South Korea and Japan. Simulation games are popular in Brazil and India.

Top mobile games of 2024

A key trend: over a third of the top 1,000 most downloaded mobile games were launched three or more years ago. Only just over 10% are new to the market. Yet even in the Top 5, we see fresh contenders.

In Google Play, the new US market entrant Last War: Survival debuted at number five, pushing out long-time favorite Roblox. Japanese users kept their top five unchanged. Meanwhile, South Korea is setting trends - Last War: Survival debuted at number two, newcomer Whiteout: Survival climbed quickly, and Royal Match returned to the top.

Although new names have appeared in Google Play’s champions list, this is more about regional shifts in popularity than entirely new players.

The App Store shows a similar trend, though user preferences differ in the same countries. Roblox remained in the US Top 5, while Japan’s leaders significantly differ from Android rankings. This confirms that user behavior can vary widely between platforms, even within the same country.

The top 3 highest-grossing countries remain unchanged – the US, Japan, and South Korea, on both Android and iOS.

Top-grossing mobile games of 2024

MONOPOLY GO! is the absolute leader.

The Scopely phenomenon combined the power of the MONOPOLY brand with proven coin collection mechanics and became the breakout hit of the year. It not only topped global IAP revenue but redefined the social board game genre.

Honor of Kings continues to be the largest mid-core title in the world. Its long-standing popularity reflects a solid player base and optimized monetization.

Rising stars of 2024

Last War: Survival and Whiteout Survival

Both are 4X strategy games launched in 2023. They raised the bar by maintaining the depth and monetization of classic 4X while adapting gameplay for broader audiences and enhancing ad monetization.

Last War: Survival was the top mobile game in year-over-year IAP growth – a model to emulate.

Also in the top: Roblox remains one of the largest and most engaging gaming worlds.

Key takeaways from the 2024 mobile gaming market

In 2024, four games – Last War: Survival, Whiteout Survival, Dungeon & Fighter, and Brawl Stars – each surpassed $1 billion in annual user spending, joining the “billion-dollar club.” This is the most significant wave of new entries since 2021, signaling a strong market recovery.

Games continue to lead.

In total, 11 titles crossed the billion-dollar mark – a record.

For comparison, non-gaming apps are growing more slowly. Since 2022, no non-gaming app has reached $1 billion in revenue for the first time (the last was Google One). In 2024, Max and Tencent Video came close but didn’t make it.

Other defining trends of 2024:

Revenue growth despite download decline

Mobile gaming proved resilient in 2024 – IAP revenue rose to $81–82 billion, a 4% increase over 2023. This is especially notable after two years of decline due to inflation and tighter regulations. Growth was driven by AMER and EMEA regions, while key Asian markets (Japan, China, South Korea) showed more modest results.

Fewer downloads but higher engagement

Total mobile game downloads dropped to 49–49.6 billion – 6–7% less than the previous year and the lowest since 2019. Still, time spent in apps rose 8% and gaming sessions 12%, showing deeper player engagement and a developer focus on live-ops for existing titles.

Casual games lose installs but gain revenue.

Casual and hybrid-casual games led revenue growth. Hybrid casuals, in particular, saw a +37% jump in IAP revenue. Ironically, even with fewer installs, casual games contributed significantly to market growth thanks to improved monetization strategies and better gameplay.

iOS surges, Android stays flat

Revenue growth came mainly from iOS, while Android remained at 2023 levels.

Market outlook for 2025

Mobile games remain the engine of the app market and its most profitable segment. Based on analytical data, the outlook for 2025 is promising.

The market is expected to grow thanks to innovation, audience expansion, and new monetization models.

However, these positive trends come with increased competition and new security and regulatory challenges.

Today’s users are more demanding and experienced. We’re not just competing with other developers but striving to meet rising expectations. The focus has shifted from acquisition to retention - growth now depends on effective monetization and retention strategies.

New markets and localization

Shifting download geographies offer access to less saturated markets, where new and exciting products can break through more quickly than in established regions. Expanding localization efforts increases our chances of success.

Genre shifts

Hybrid games and strategy titles are the way forward. Strategy remains the fastest-growing niche - just 4% of installs account for 21.4% of revenue.

What developers should prioritize in 2025:

- Focus on retention, engagement, and ARPPU

- Cross-platform strategies – success requires working across both Android and iOS

- Innovation in genres and gameplay mechanics is more important than "just another release."

- Localization and marketing tailored to key markets (US, Japan, South Korea, India)

ASO for mobile games remains a core element in building a successful strategy. Promotion and advertising are puzzle pieces that create the complete picture of visibility and top search rankings.

Check out our previous article for more details on 2025 trends and forecasts.

The complete mobile app market report is available here.

Українська

Українська  Русский

Русский  Español

Español