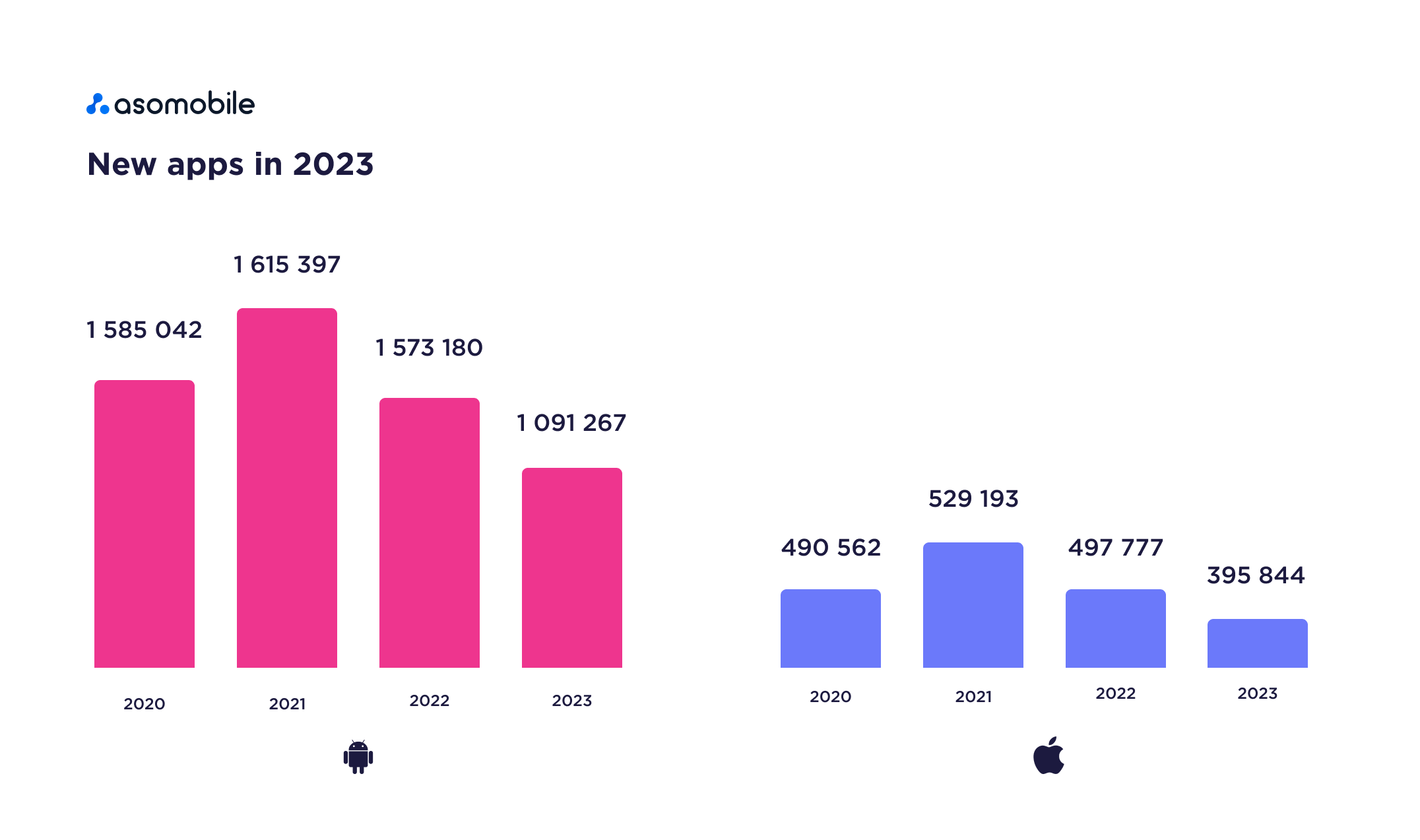

Mobile application market 2023 - results and trends

2023- what was it like, and how do we remember it in the context of the mobile application market? First, let's look at the performance of our main stores this year.

Main indicators of the App Store and Google Play for 2023

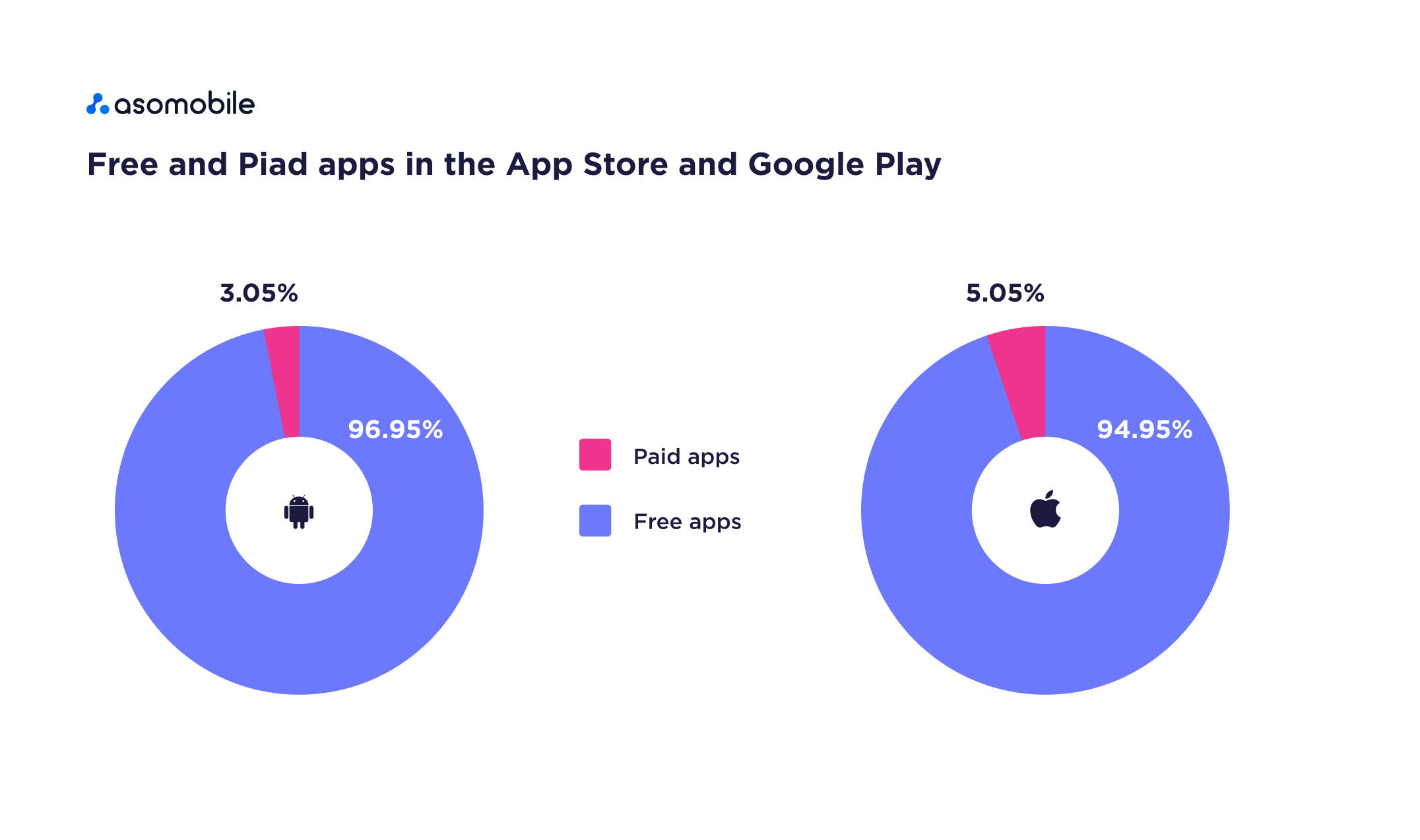

The distribution of paid and free applications has not changed much, and the proportion has remained unchanged since last year. The App Store has a slight percentage advantage over Google Play in paid apps. Which in terms of quantity is still fewer than that of a competitor.

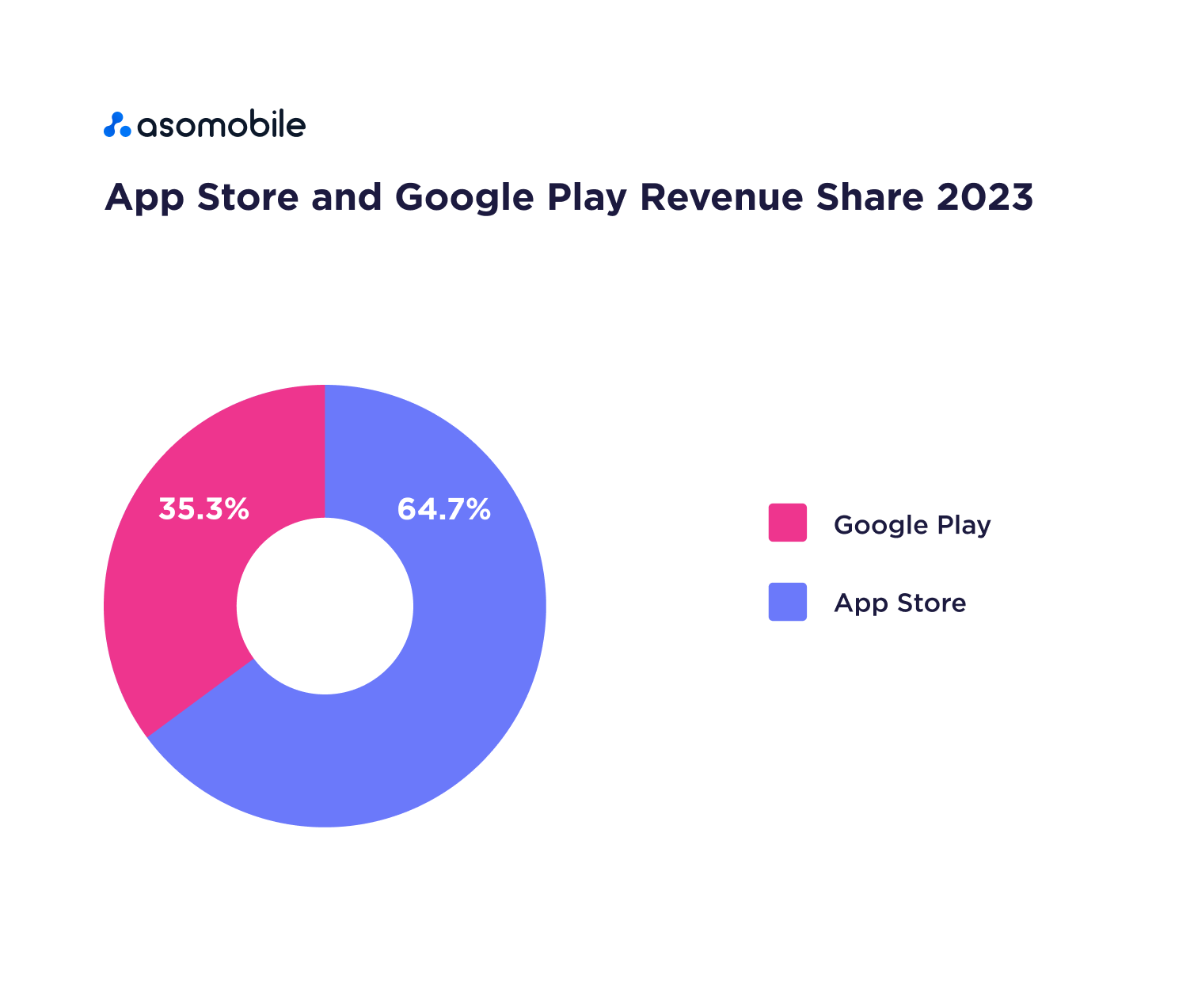

Traditionally, the revenue share of mobile application platforms in 2023 is as follows:

Which means Google Play revenue is $58.62 million compared to the App Store - $61.47 million. This data does not include December 2023, but the trend has continued this year - iOS applications traditionally generate more income.

9 facts about app usage in 2023

In addition to the main indicators of app stores, kindly pay attention to the depth of integration of the smartphone into our lives, which will help both in assessing prospects and highlight the importance of user preferences. According to Simublade and their statistical report:

1. 88% of user time is spent using applications. So the smartphone now performs its original functions (calls via mobile communications) only 12% of the time it is active.

2. Android app retention rates are 22.6% one day after download, 6.5% seven days after download, and 2.6% 30 days after download. Retention rates for iOS apps are 25.6% one day after download and 4.3% 30 days after download.

3. 70% of users delete apps due to slow speed.

4. About 50% of users complain about apps that quickly drain their battery.

5. About 54% of users, especially millennials, have more than 3 apps active at the same time.

6. Applications for social networks remain in the top popularity, followed by instant messengers.

7. The average user has 80 applications installed, of which about 10 are used constantly.

8. The installation source remains search, social networks and application stores.

9. Gender inequality is no longer inequality. Men and women differ in user behavior and preferences, depending on the category. But at the moment, the average time of use for all categories is equal, although for example, men are a little more passionate about the Games category, while women give preference to Travel.

Global economy and mobile application market

We do not exist in a vacuum, and the impact of the economy on both users and developers is obvious. Recession, inflation, military conflicts - all this did not make 2023 a pleasant year, but also made its own adjustments, both in the reduction of budgets for advertising and promotion, and in the preferences of users who think twice before buying, installing, subscribing.

Attraction vs. Hold

If we look at advertising budgets and promotional funds, then according to research, the downward trend continues and will continue next year. Doing more for less has become the motto of our industry and will continue to be for some time to come. And since there are less funds to attract new users, efforts should be redirected to retaining existing users. We remember that now the level of user churn is more than 25% in the first three days after installation - a great indicator, which just shows that it used to be easier to find a new user than to retain him. Now the situation has not become easier, but the market has clearly realized that it is necessary to change and work on retention. UA has become more expensive due to the high level of competition in the market, increasing user expectations, technological progress and many other factors.

Users, in turn, are also susceptible to crisis phenomena, which leads to more moderate and cautious spending, although the degree of penetration of mobile applications into their lives is now higher than ever.

ASO & VSO

Search engine optimization for app stores has not and will not lose its relevance on the app market. Recently, one can add to this the popularity of voice search.

ASO is heavily influenced by AI tools that offer both analytics services and app stores themselves. Just remember Custom Product Listing from Google Play, where all 50 custom pages can be generated using artificial intelligence.

Visual optimization has also become more diverse thanks to AI services, but in the end everything is decided by users, which makes A/B tests still relevant on our agenda.

The popularity of voice assistants such as Alexa and Siri has led to the concept of VSO - voice search optimization. Optimizing our apps through voice search will be a great competitive advantage in the crowded mobile market.

User Behavior

In our article about UA trends for 2024, we paid a lot of attention to user behavior and the role of contextual targeting. But here it is worth mentioning user path research. Now we can win them only by optimizing their path to our app and in our app. How and why a client comes to our app very much depends on the category of it, age and social group of the potential audience. Choosing to distribute the application as widely as possible across all marketing channels only leads to the dispersion of advertising budgets, which in the current market is very wasteful. It is the ability to correctly target our user, find his habitat and a channel for promotion in this environment that will allow us to emerge victorious from this situation.

Our users are maturing along with the market, and the demands for applications and games are growing. Let's take a look at 9 facts about using apps - users are no longer willing to tolerate technical failures, applications that consume too many resources, send too many notifications - the first to be deleted, or if the installed app is too difficult to understand. The high level of competition has set high standards for our users in terms of quality and expectations from apps, and crisis events make users think twice before purchasing or subscribing. What this does is forces us to change approaches to app monetization.

Monetization of mobile games and apps

Consumer spending also increased in 2023, and in-app purchases in the US showed +12% growth. The indicator is positive as users are still spending money on games and apps. But for you and me, this factor, in combination with the previous ones, only says that we should not miss the variety of forms of monetization. Users are ready to pay, we just need to explain for what and how. We'll be sure to do a detailed review of game and app monetization strategies for 2024 in the near future. In the meantime, it’s worth mentioning that it’s more important than ever to make such strategies based on analytics - after all, different forms of monetization work effectively in different categories. One-time in-app purchases are good in the Books, Sports, subscription categories for the Fitness and Health, Productivity and Services categories, and don’t forget about hybrid approaches.

AI and the mobile application market

It would be wrong to talk about the results of 2023 and keep silent about AI. This year has become a triumph and a victorious march of artificial intelligence in all industries, and of course mobile applications and games have not been left out.

According to Data.ai, the launch of Chat GPT in 2023 sent shock waves across the world. In the US, Google searches for AI have increased nearly 10-fold since last year, peaking in April 2023.

Downloads of Generative AI apps have grown ninefold over the year. At the same time, the number of AI chatbots has grown 72 times, leading to the emergence of a whole new app sector that will grow steadily in 2024.

Excluding AI Chatbots and AI Art Generator, AI app downloads increased by 60% in 2023 due to the addition of new features and functionality. The best genres for AI implementation were photo and video editing applications, as well as selfie editing applications.

What's the end result?

As we approach the end of 2023, the mobile app market continues to be a dynamic and rapidly evolving space:

Growth trajectory. The global mobile app market is expected to maintain its growth trajectory. The expansion is being driven by rising smartphone penetration, faster internet speeds and a growing user base in emerging markets.

Income streams. In-app purchases, advertising and subscription models remain the main sources of revenue. The trend towards subscription models, especially in non-gaming apps, continues to grow.

User preferences. There is an increasing preference for apps that offer personalized experiences. This includes applications that use artificial intelligence and machine learning for customization.

Interaction models. Users spend more time on apps that offer comprehensive solutions, such as super apps that integrate multiple services (e-commerce, payments, social media, etc.).

AI and machine learning. AI is increasingly being used for personalized content recommendations, predictive analytics, and increased user engagement.

Augmented reality (AR) and virtual reality (VR). These technologies are becoming increasingly common, especially in gaming, education and retail applications.

5G integration. The introduction of 5G enhances the functionality of applications, delivering more complex and immersive experiences.

Rise of Niche Apps: There is a growing market for niche apps that cater to specific interests or communities.

Health and wellness apps. Health, fitness and wellness apps are expected to grow significantly, driven by an increased focus on personal and mental health in an environment of widespread uncertainty.

Keyword optimization. Tools like ASOMobile for keyword research and optimization are still critical to improving app visibility.

Localization. Adapting app listings for different regions and languages is key to conquering global markets.

User reviews and ratings. Constantly monitoring and responding to user reviews can significantly impact your app's rankings and conversions.

Privacy and data security. Apps will have to comply with increasingly stringent data privacy laws and regulations. Both Google Play and the Apple App Store are updating their policies, affecting how apps are sold and monetized.

The mobile app market in 2023 is characterized by technological advancements, changing consumer behavior, and evolving monetization strategies. For ASO professionals, staying on top of these trends and using analytical tools to analyze and optimize the market comprehensively is the key to success in this competitive environment.

Our annual mobile app market report 2023 will be out soon; don't miss it.

Українська

Українська  Русский

Русский  Español

Español