Mobile App Market Report 2024

Our annual Mobile App Market Report for 2024 provides a comprehensive analysis of the key trends shaping the app ecosystem across the App Store and Google Play. We explore significant platform changes, category dynamics, top-ranking apps, mobile gaming performance, downloads trends, and revenue growth trends. Additionally, we assess the overall market landscape, competitive environment, and the growing impact of artificial intelligence and attempt to forecast what to expect in 2025.

Key Market Figures for 2024

- Number of new apps launched – 136 billion, reflecting a slight decline compared to 2023

- Revenue from in-app purchases – $150 billion, marking a 12.5% increase year-over-year

- Additional market statistics and insights into last year’s key trends will be covered in detail in the report

🔹 Note: These figures do not include data from the Chinese market

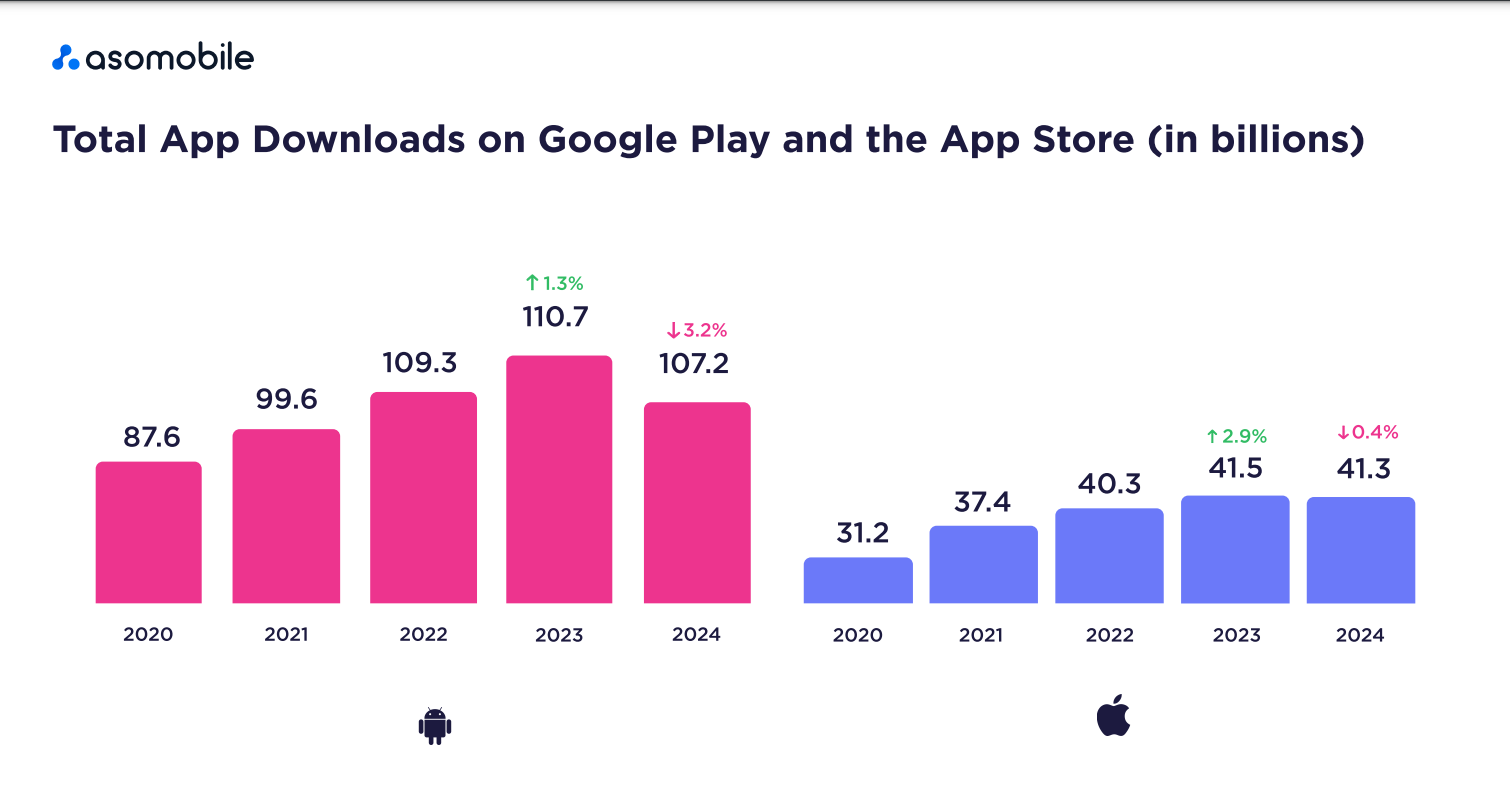

Total App Downloads on iOS & Android in 2024

We observed a gradual slowdown in app installation growth for years, but the trajectory remained positive. However, 2024 marks a fundamental shift—not just a slowdown but an actual decline in downloads compared to the previous period. This signals a saturated market where users have become more selective, prioritizing quality over quantity regarding app installations.

As the year comes to an end, the total number of app downloads stands at:

- Google Play – 107.2 billion downloads

- App Store – 41.3 billion downloads

As expected, Android continues to dominate total app and game installations. This aligns with market share data: According to Statista, in Q4 2024, Android maintained its position as the world’s leading mobile operating system with a 72% market share. Meanwhile, its closest competitor, Apple’s iOS, accounted for 27.5% of the market, with the remaining share split among minor operating systems now holding only a marginal presence.

Top Downloaded Apps on Google Play & App Store in 2024

As usual, the top 10 includes Instagram, Google, and popular messaging apps. On Google Play, Instagram lost its leading position to WhatsApp, which finally became the most downloaded Android app. Meanwhile, on the App Store, Instagram dropped to seventh place, a significant decline from its third-place ranking in 2023. Despite its success on Android, WhatsApp lost some ground on iOS, slipping from sixth to ninth place.

Among the newcomers to Google Play’s top 10, an AI-powered app debuted, which is no surprise given the growing influence of artificial intelligence. ChatGPT entered the ranking at tenth place, marking a strong first appearance. However, iOS users proved to be even bigger AI enthusiasts - on the App Store, ChatGPT surged to fourth place, pushing aside competitors to secure a dominant position.

Another notable newcomer is Threads, which entered Google Play’s top 10 at seventh place. iOS users, however, showed even greater enthusiasm for social interactions, propelling Threads to the number one spot on the App Store.

Among the apps that dropped out of the top rankings, the most striking case is Facebook, which failed to withstand the competition and fell out of the iOS top 10 entirely.

Now, let’s move on from downloads to a more pressing topic - which apps generated the highest revenue in 2024.

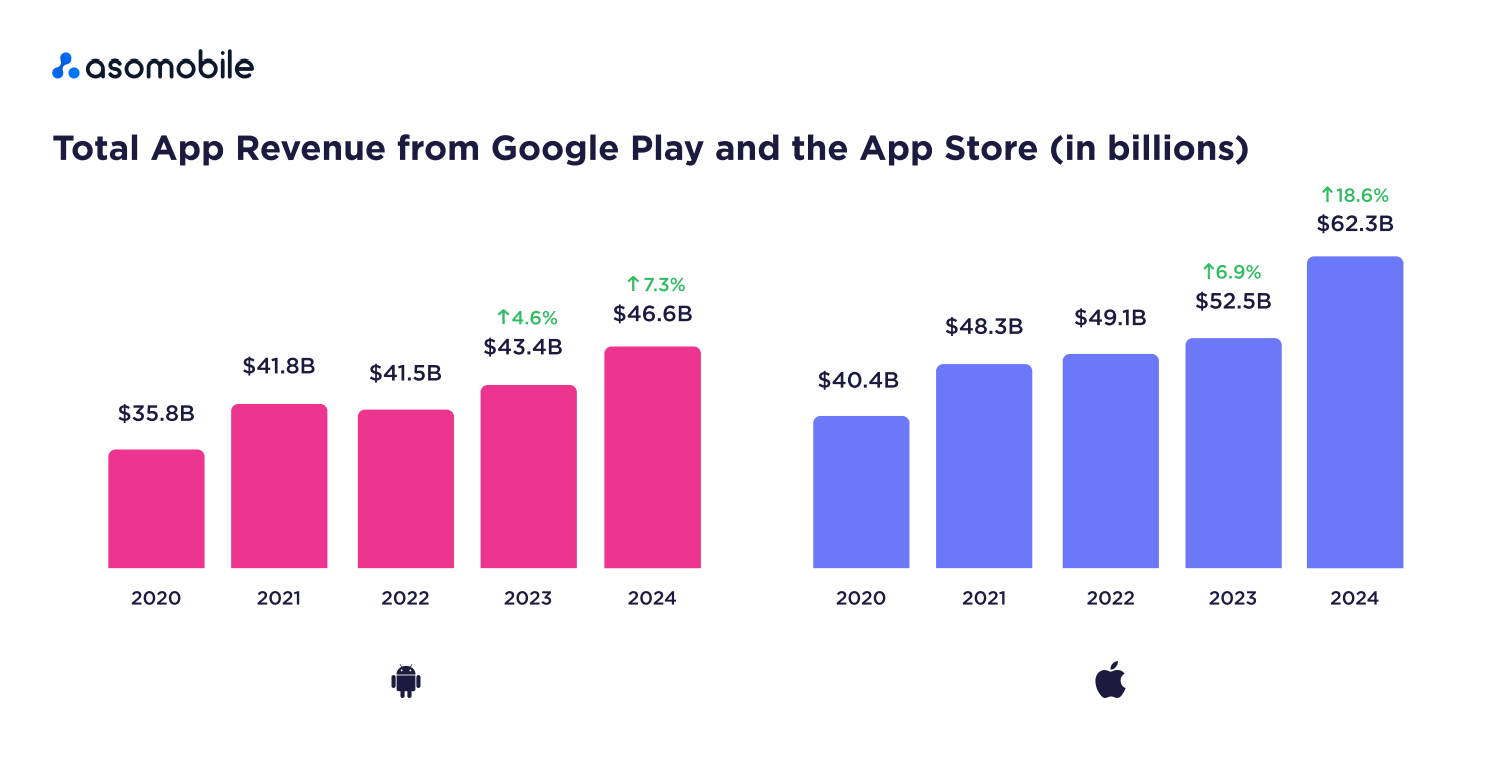

App Revenue on Google Play & App Store in 2024

The app market demonstrated strong positive growth throughout 2024. This was particularly evident in the iOS segment, which once again proved to be the primary driver of market expansion. Over the year, Google Play recorded a revenue increase of 7.3%, while the App Store outpaced its competitor, closing the year with an 18.6% growth rate. This performance is reminiscent of 2021, when the market experienced nearly 20% growth, reinforcing confidence in its long-term potential.

Apps that consistently generated high revenues were key contributors to this impressive market growth. Let’s take a closer look at which applications led the way.

Google One remains one of the most popular apps and the highest-earning one, securing the top position on Google Play for the third consecutive year. In 2024, it once again left TikTok in second place. If you’re an Android user, there’s a high chance you have a Google One subscription for expanded cloud storage - making its long-term dominance in revenue perfectly logical.

Speaking of TikTok, the app has maintained a solid second place in recent years, steadily pushing mobile games further down the revenue rankings.

YouTube was the most profitable app for Apple and its developers on the App Store. Though the phrase “was” might suggest an element of surprise, there’s nothing unexpected here. YouTube has held the number one spot in App Store revenue since 2020, proving resilient against economic crises, pandemics, and global conflicts, none of which have been able to challenge its dominance.

TikTok secured second place in revenue on both platforms, which seems more than fair. Meanwhile, Tinder, which has traditionally been more popular among iOS users, maintained third place in the App Store’s top-grossing apps.

The rankings for mobile games saw some internal reshuffling. The breakthrough of the year was MONOPOLY GO!, which unexpectedly surged to third place in Google Play revenue. Meanwhile, Roblox and Candy Crush Saga continued to generate strong earnings for developers, maintaining their appeal among players.

One of the most remarkable success stories of the year comes from the App Store’s top 10, where Whiteout Survival made a spectacular entry at 10th place - an astonishing achievement for a game that rapidly climbed the revenue charts.

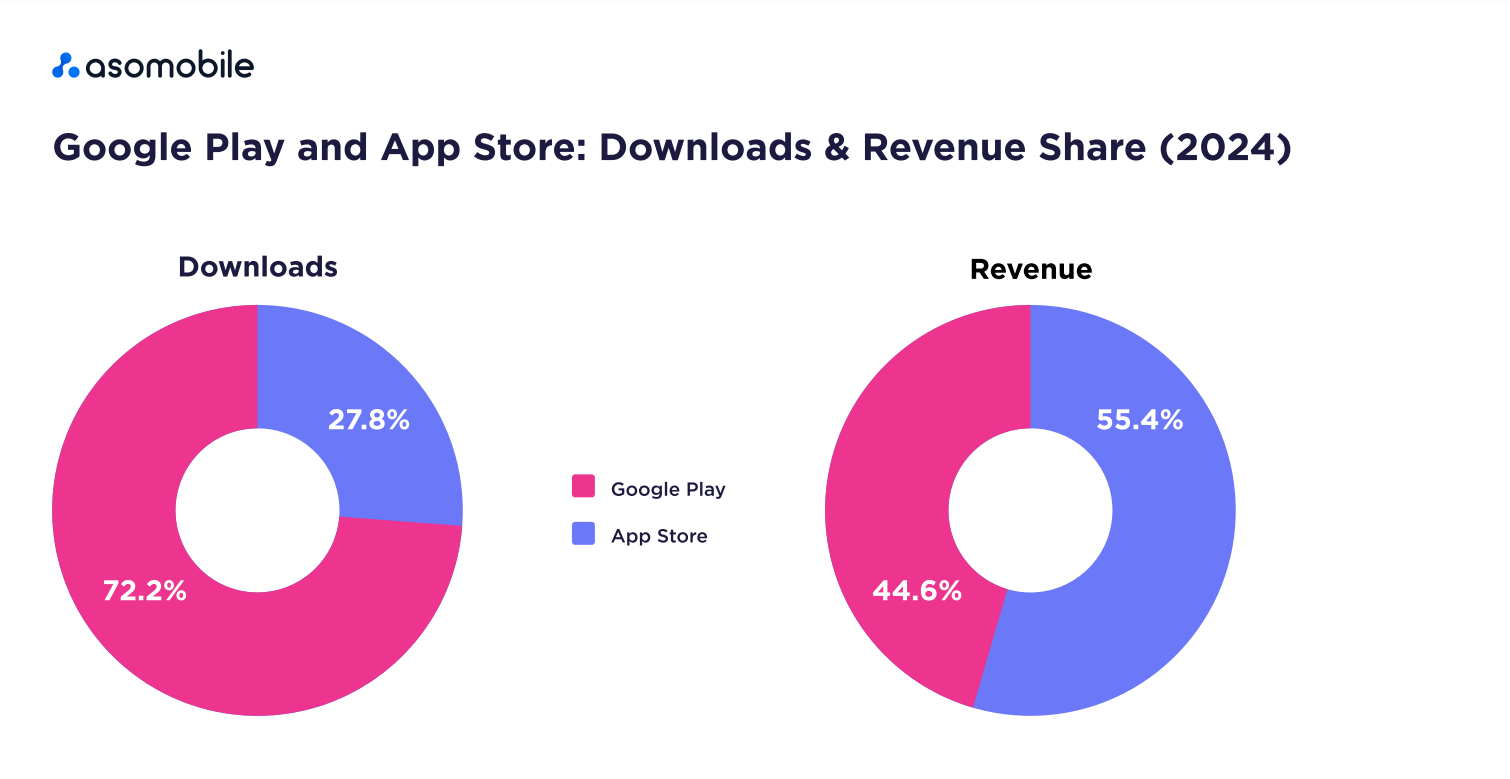

Google Play vs. App Store Downloads in 2024

The ratio of downloads between Google Play and the App Store remains at its usual level, fluctuating slightly but without any dramatic shifts. However, the App Store's faster installation growth rate is becoming more evident as it expands faster than its Android counterpart.

iOS apps have traditionally dominated revenue, and this trend remained largely unchanged in 2024. There was a slight dip in App Store revenue share, but only by a fraction of a percentage point—nothing significant enough to alter the overall landscape.

Let’s look at categories - who leads the charts, what has changed since last year, and how the competitive landscape compares across the two platforms.

Top Categories by Downloads on Google Play & App Store 2024

Entertainment unexpectedly claimed the top spot in downloads on Google Play, while Simulators advanced from third to second place. The App Store demonstrated a similar dynamic - simulators led the installation rankings, relegating Photo and video apps to their traditional second position.

Surprisingly, there was a rapid surge in Social Network downloads across both stores. These market patterns reflect a notable shift in consumer interests and installation trends.

With a clear understanding of what users are installing, the next question arises: How does this translate into revenue? Do users' preferences in what they install align with their willingness to pay for those apps?

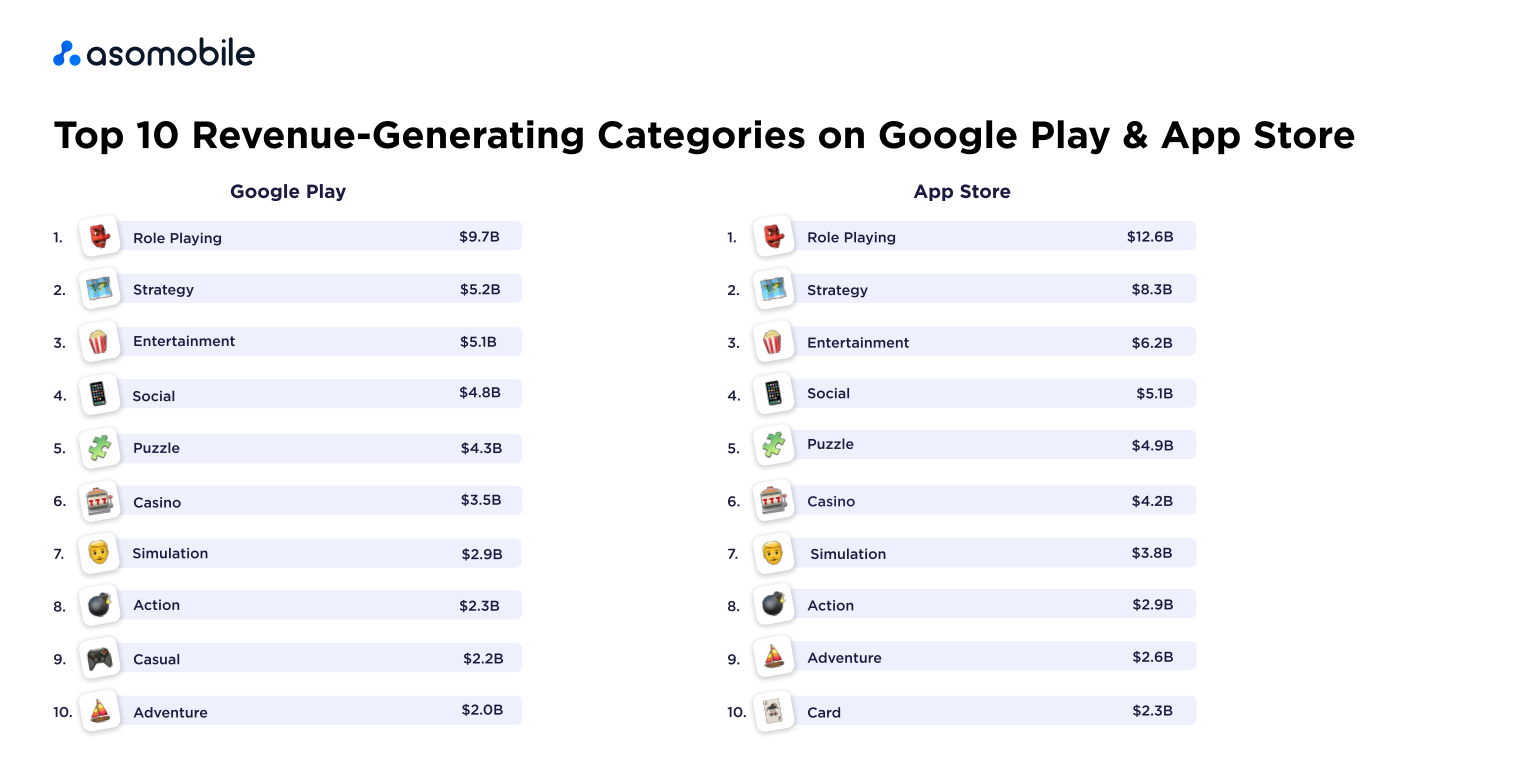

Top Revenue-Generating Categories on Google Play & App Store in 2024

The gap between downloads and revenue rankings remains stark. Role-playing games (RPGs) and Strategy Games dominate the highest-earning categories on Google Play and the App Store. These categories have consistently held their leading positions for years, reaffirming their role in the ongoing debate of profitability regarding mobile apps vs. mobile games.

Despite the stable dominance of gaming categories, there have been some shifts in the top 10 revenue rankings. Notably, Entertainment climbed to third place, a trend that aligns with the category’s strong download performance. This correlation suggests that user engagement with entertainment apps is high in both installations and monetization, further strengthening their market position.

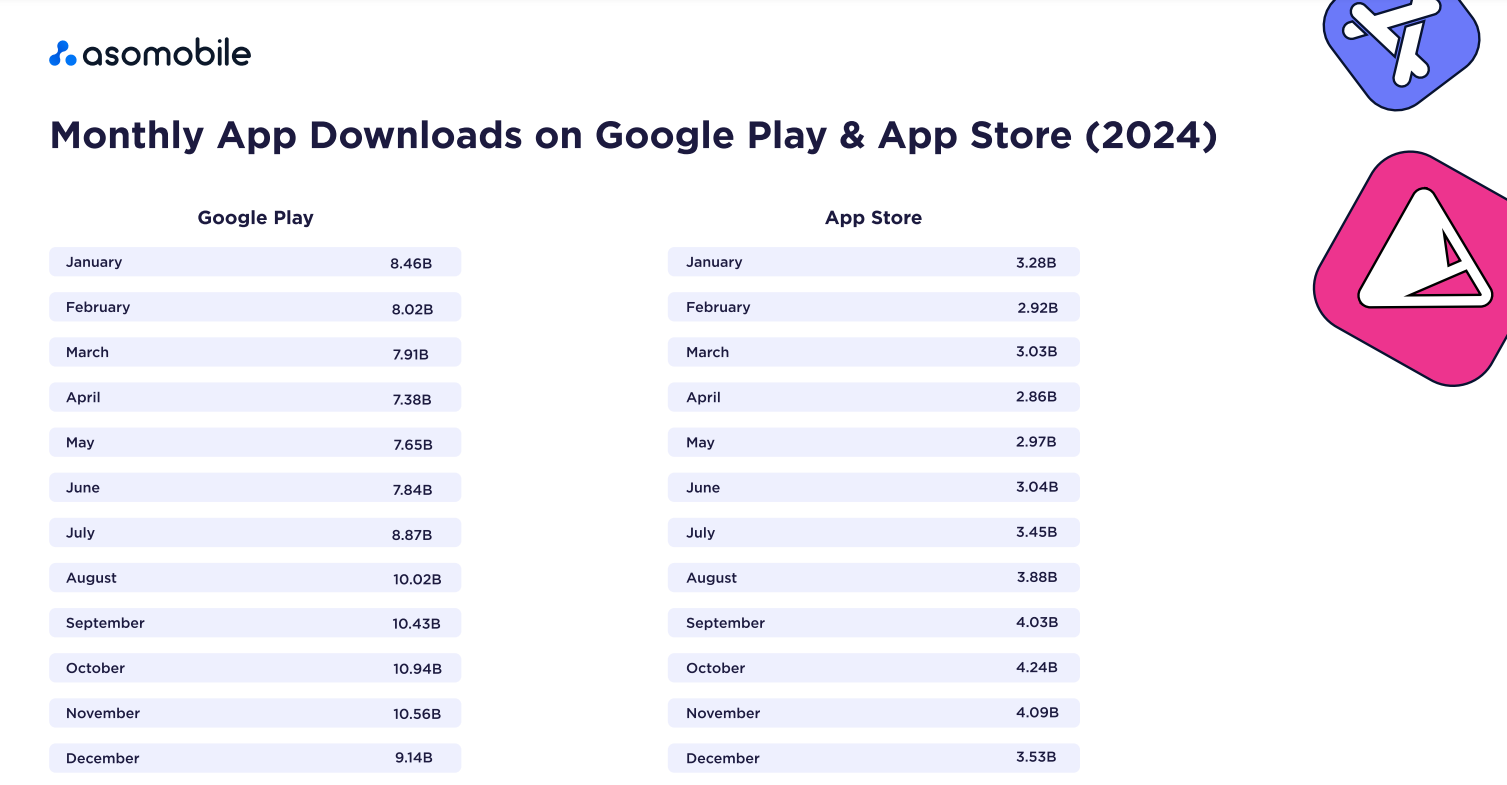

Seasonal Trends: When Do Users Download and Spend the Most?

Autumn is undoubtedly the busiest period for app downloads and user activity. Whether it’s the worsening weather that encourages people to spend more time on their phones or the back-to-school season driving higher installation rates, this period consistently sees a surge in app engagement.

Revenue trends follow the same pattern - October is the golden month for the calendar and developers' earnings. It remains the peak season for in-app spending, reinforcing its importance for marketers and publishers planning annual monetization strategies.

Geography of Revenue and Downloads in 2024

For Google Play, India remains the ultimate goldmine for apps and mobile games, continuing a years-long trend of dominance in downloads. Brazil and the U.S. also maintain their leadership positions, traditionally swapping second and third place in the apps category. However, a surprising shift occurred in mobile gaming—Indonesia surged to third place, pushing Brazil out of the top three.

Despite this shift in gaming downloads, there were no new entrants in Google Play’s top 10 countries for total installs. The ranking may fluctuate slightly within the existing group, but the same markets remain key drivers of download volume.

As for the App Store, the leading countries in installations paint a different picture. Here’s how the rankings shaped up:

The U.S. continues to dominate the App Store rankings in apps and mobile games, maintaining its long-standing leadership. This is no surprise, given that iOS remains the dominant platform in this market. The top three countries remained unchanged from the previous year, while Mexico climbed to fourth.

The overall top 10 countries for iOS downloads remain stable, with almost no internal ranking shifts, highlighting the consistency of Apple’s strongest markets.

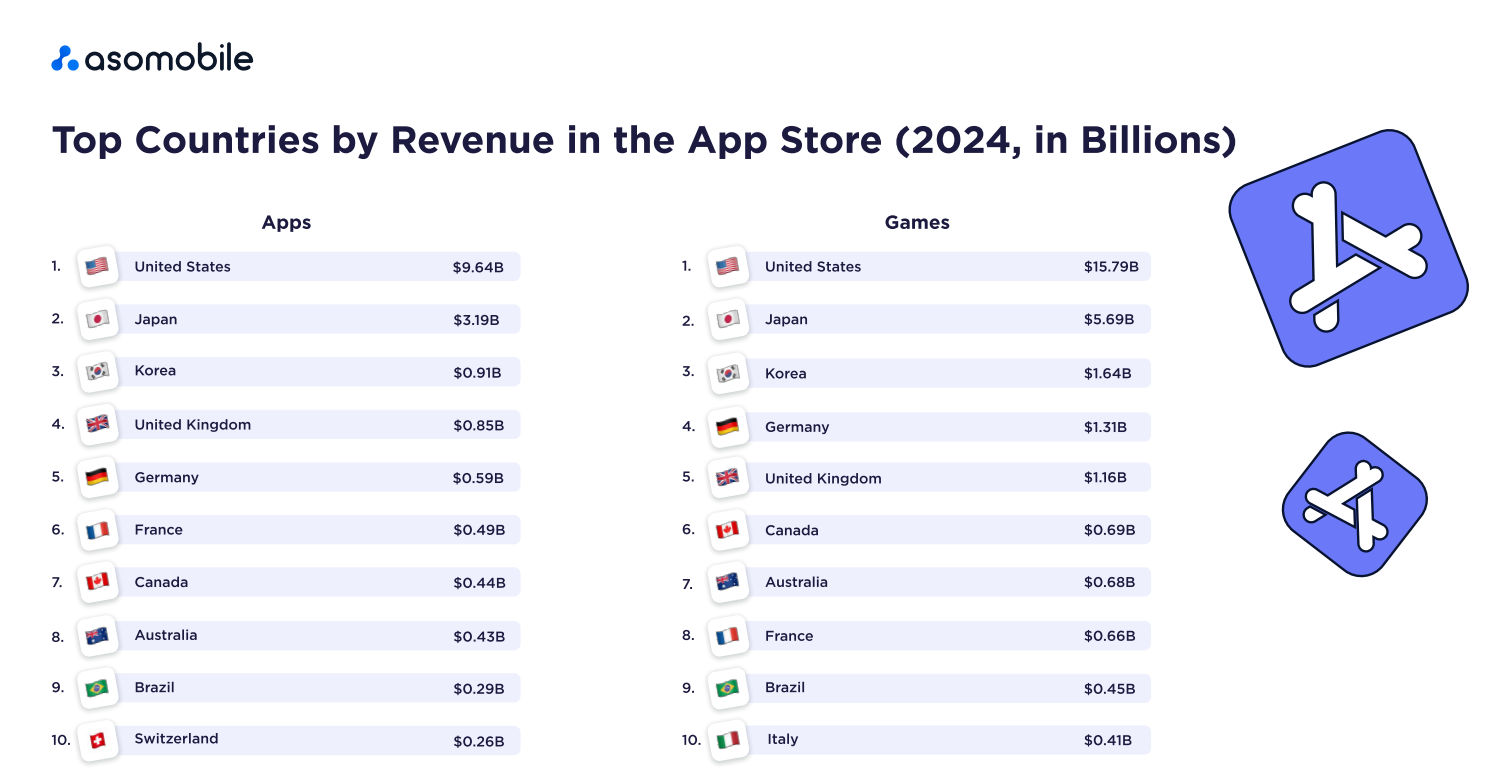

However, regarding revenue, the geographical landscape tells a very different story. Let’s take a closer look at where the most significant spending happens.

Revenue by Country in Google Play & App Store in 2024

There were few surprises this year regarding the top-grossing countries for apps - most countries retained their positions. The only notable change was Italy entering the top 10, pushing Saudi Arabia out of the ranking.

The leaderboard in the mobile gaming category remained completely unchanged, with the same key markets continuing to drive revenue.

For the App Store, the top revenue-generating countries are the usual players. The U.S. dominates across all categories and platforms, followed closely by Japan, which has held second place for several years. South Korea completes the top three, reinforcing its role as one of the most substantial mobile gaming and app-spending markets.

Aside from Saudi Arabia dropping out of the top 10, the overall rankings in apps and mobile games remain almost identical to the previous year.

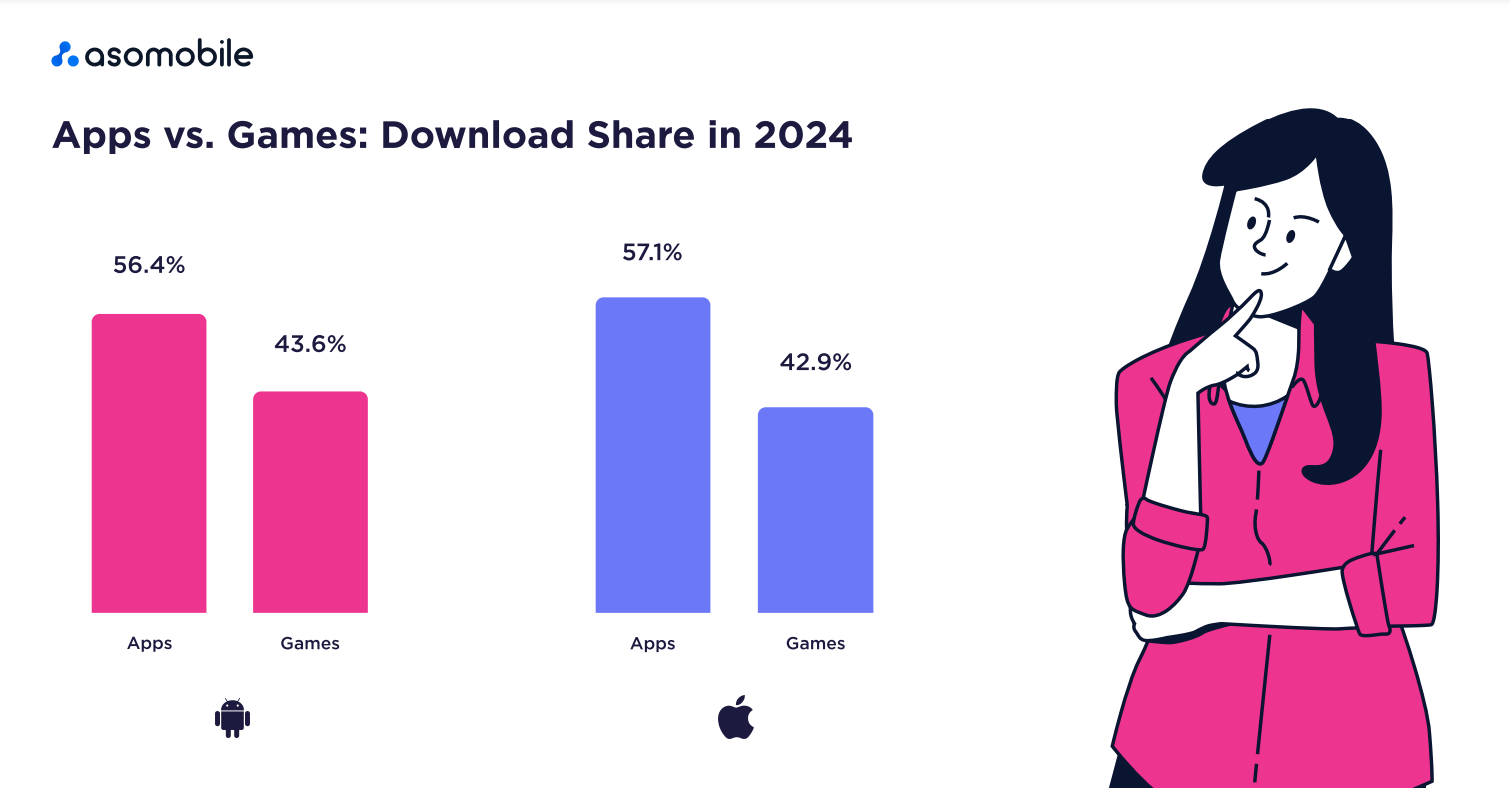

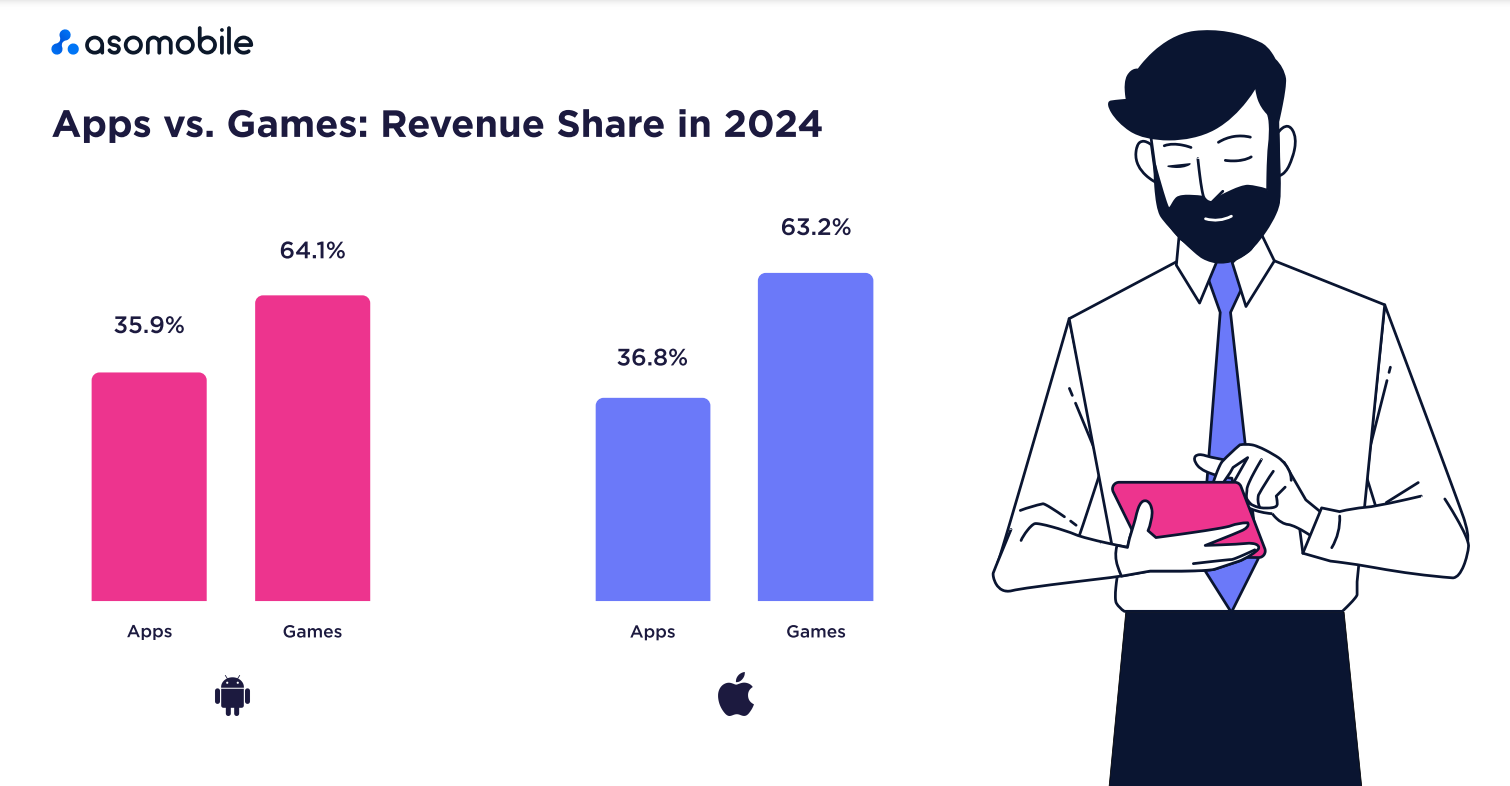

Apps vs. Games: Downloads & Revenue in 2024

The balance between apps and games in downloads has constantly shifted since the mobile app market first emerged. However, 2024 mirrored 2023, reaffirming the dominance of non-gaming apps. The proportions remained almost unchanged, with apps continuing to capture the majority of installations across both Google Play and the App Store.

There were no surprises when it came to revenue. Mobile games remain the most profitable category, consistently generating higher developer earnings. That said, the revenue split between apps and games in 2024 showed a slight tilt toward apps, indicating a gradual diversification in monetization trends.

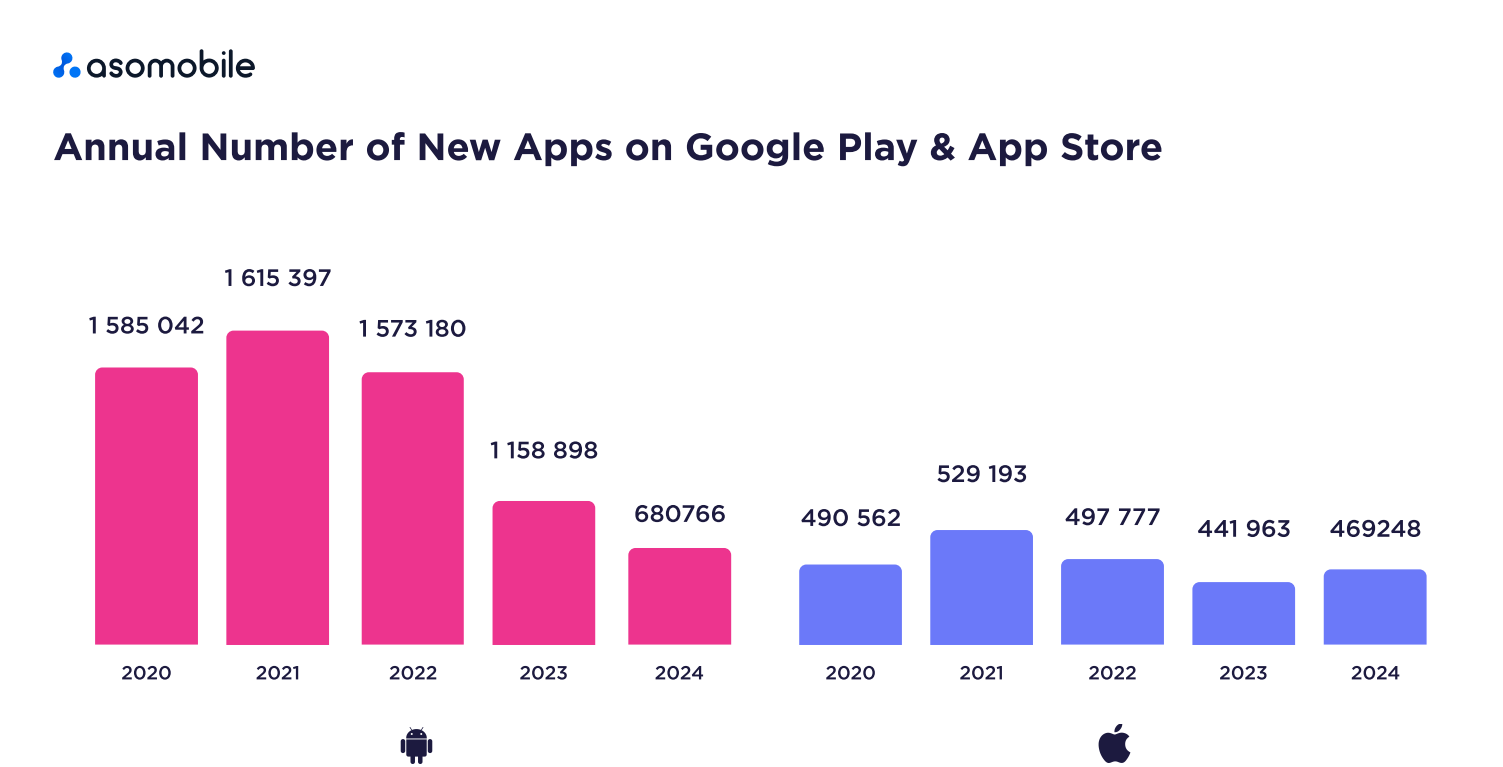

New Apps in 2024: Trends and Market Dynamics

The number of new apps on Google Play has declined since 2021, though the figures remain substantial. Meanwhile, the App Store presents a more optimistic picture, showing a slight increase in new app releases compared to 2023.

The market is becoming increasingly saturated and fiercely competitive, with many niches already filled. As a result, the barrier to entry for new developers continues to rise. However, the beauty of the mobile app market lies in its unpredictability - a single new app can quickly transform from an unknown newcomer into a billion-dollar unicorn.

In many ways, the mobile app industry remains a market without borders, where success can come from unexpected places, making it one of the most dynamic digital sectors today.

2024 Summary and 2025 Forecasts

How 2024 Ended

Despite a slight decline in new apps, overall market revenue continued to grow, reinforcing the trend toward higher monetization of existing audiences.

Growth of Subscriptions and In-App Purchases

The increasing reliance on subscriptions and in-app purchases indicates that users are more willing to pay for convenience and exclusive content. This reinforces freemium and paywall models as dominant monetization strategies while one-time purchases lose relevance. Developers must balance free and premium content to avoid alienating users with aggressive monetization tactics.

What This Means for Developers

- Success now depends on Lifetime Value (LTV), not just instant transactions.

- Subscriptions only work if user engagement is high.

- An imbalance between free and paid content can lead to high churn rates.

- AI must be leveraged to personalize subscription offers, ensuring users see the value of a subscription from the start.

- Payment flows need to be optimized, making subscription sign-ups and renewals seamless through Apple Pay and Google Pay.

The Rise of Non-Gaming Apps

The market is shifting toward multi-functional services, with users increasingly willing to pay for automation, convenience, and personalized content.

What This Means for Developers

- Competition is intensifying—offering a unique user experience is key to standing out.

- User retention is now more critical than acquisition, as users commit to long-term service subscriptions rather than downloading impulsively.

- Monetization is subscription-driven, with successful non-gaming apps balancing free features with premium upgrades.

- AI-driven personalization is a necessity for optimizing user experience and increasing conversion rates.

- Cross-platform integration is essential—a seamless mobile and web experience enhances user convenience and engagement.

- Expanding in-app ecosystems through third-party service integrations boosts retention and user value.

Declining Installations

The drop in downloads confirms that the market has reached maturity. Acquiring new users is becoming more expensive and complicated, pushing developers to focus on retention, LTV, and re-engagement strategies.

What This Means for Developers

- CPI (Cost Per Install) continues to rise, making UA (user acquisition) more costly.

- Retention metrics and UX (user experience) are now top priorities.

- Revenue growth is shifting from new downloads to maximizing value from existing users.

How to Adapt

- Implement retention strategies like personalization, loyalty programs, and AI-powered behavioral analysis.

- Test hybrid monetization models - a mix of subscriptions and in-app purchases is essential.

- Optimize UX and engagement, ensuring users stay active in the app longer.

AI Apps: The New Market Driver

The AI app segment grew by 200%, signaling a global shift toward automation and personalized services. ChatGPT and other AI-powered tools set records in user engagement and session time, proving that AI is no longer just a technology—it’s now a core competitive advantage.

What This Means for Developers

- AI apps require high computational power, so infrastructure costs (servers and APIs) must be considered.

- Users expect AI to be highly accurate, making constant algorithm refinement essential.

- AI app monetization must be flexible, incorporating freemium, subscriptions, and enterprise pricing.

- Investing in AI-powered features is critical. Developers should implement freemium models with premium AI capabilities while also testing AI-based personalization tools.

Key Market Insights from 2024

Top-Grossing Apps

Subscriptions and premium content continue to dominate, with video platforms and social networks maintaining leadership due to high user engagement.

The Globalization of the Mobile Market

While developers target international audiences, domestic players dominate key markets like the U.S., China, and Japan.

Total iOS & Android Downloads in 2024

The slowdown in installations confirms market saturation, reinforcing the importance of user retention strategies.

Top Downloaded Apps on Google Play & App Store

AI apps, messaging platforms, and social networks remain dominant. A new trend is the rise of niche communication platforms like Threads.

App Revenue on Google Play & App Store

App Store remains the primary revenue generator, while Google Play leads in total downloads.

Google Play vs. App Store Downloads in 2024

While Android still leads in total installations, the growth in App Store revenue highlights higher spending power among iOS users.

Top Downloaded Categories on Google Play & App Store

User preferences are shifting toward Entertainment and Simulation apps, creating new opportunities for developers in these niches.

Top Revenue-Generating Categories on Google Play & App Store

Games remain the most profitable category, but entertainment and content platforms are seeing consistent revenue growth.

Geography of Revenue and Downloads in 2024

Emerging markets drive downloads, while revenue remains concentrated in the U.S., Japan, and South Korea.

Apps vs. Games

Non-gaming apps are gradually gaining a larger share of the market regarding downloads, but gaming remains the undisputed leader in revenue.

New Apps in 2024

The market is increasingly competitive, making app launches more challenging. Success now depends not just on innovation but also on effective marketing strategies.

2025 Forecasts

AI, omnichannel experiences, and cross-platform ecosystems will shape the mobile market 2025. Developers must prepare for new regulatory challenges while focusing on retention and user engagement.

The mobile app industry is maturing, competition is intensifying, and revenue growth is now driven not by downloads but by effective monetization and long-term user retention.

The key drivers of 2025 will be:

- AI integration and personalization

- Hybrid monetization models

- Expansion into emerging markets

Developers who embrace AI-driven user experiences, optimize engagement strategies, and adapt monetization tactics will stay ahead in the evolving mobile landscape.

Download the full report.

Українська

Українська  Русский

Русский  Español

Español