Mobile Game Industry ASO Trends Report

Let's start our trend report with an overview of the most anticipated mobile games of 2023, brighten up the dry statistics a bit:

- Call of Duty Warzone Mobile

- Honor of Kings

- Valorant Mobile

- Assassin's Creed Codename Jade

- Age of Empires Mobile

- Sims 5 Mobile

- The Division Resurgence

- Clash Heroes

- Final Fantasy VII: Ever Crisis

- Need for Speed

Please note that many games are mobile versions of popular PC games, which confirms the fact that large game development companies have recognized the potential of the mobile games and apps market and are therefore taking steps to capture their user share in the growing market.

General trends in the mobile games market

The mobile gaming industry has quickly become one of the most profitable and growing entertainment industries in the world. The most popular mobile games are now steadily exceeding $100 million every month, with the majority of consumer spending occurring in Asia, thanks to countries like China, South Korea, and Japan.

With what indicators did the mobile games market come to 2023, the year of the first crisis phenomena and the slowdown in the growth of the mobile market as a whole. According to data.ai data for the first quarter of 2023, we are seeing an increase in gamer spending and therefore an increase in the profitability of mobile games. Mobile gamers currently spend about $1.63 billion and download nearly 1.2 billion games a week worldwide.

The Asian and South American regions are helping to keep the bar high, offsetting the crisis in other geographic regions. Thus, based on the data.ai report, the United States, South Korea and Japan made the largest contribution to the consumer spending of Android users in the first quarter of 2023. Similarly, for iOS, the highest numbers were in the US, China, and Japan.

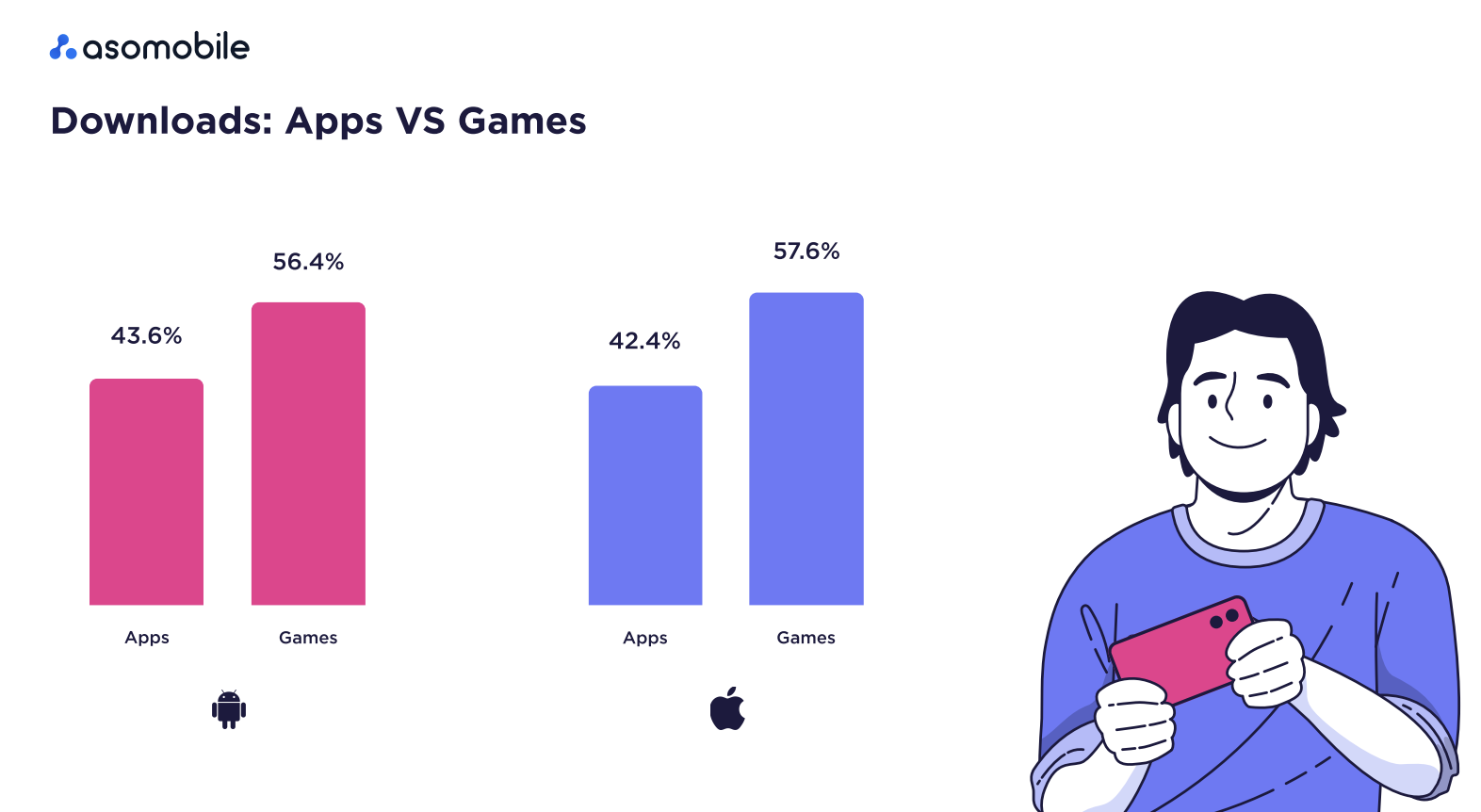

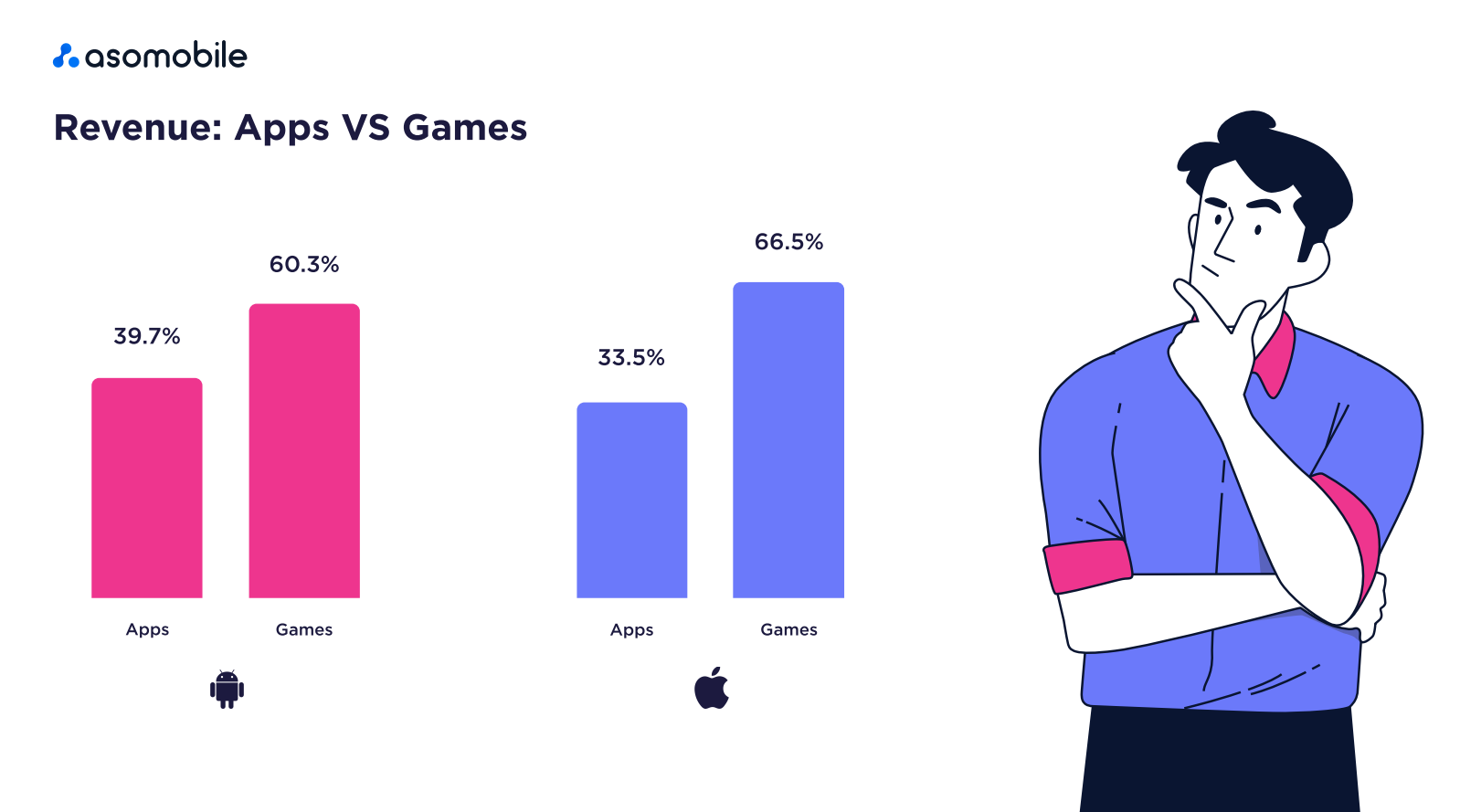

The trend of the prevalence of games over applications in terms of revenue and downloads is also in place at the end of 2022 - check it in our annual report.

This once again emphasizes the prospects for games as a driver of the mobile games and applications market.

If you look at the overall Top Grossing Apps, you'll see that games make up quite a bit of it. For example, Google Play has only three apps in the top ten profitable ones, the rest are games. The App Store more evenly divided honorable places in half.

Overview of the mobile games market based on Android

Let's see how the Google Play gaming sector ended the year 2022 - we will divide our estimates into the analysis of downloads by category, country, and also evaluate the income of this market.

Downloads

Google Play at the end of 2022 showed the following Top 10 download categories:

Compared to last year, the top three were Casual Games (the most popular category in recent years), Simulators, and Games in the Action category. Pushing RPG and Strategy almost to the bottom of the list. You can find detailed information on categories in the ASOMobile Category Intelligence tool.

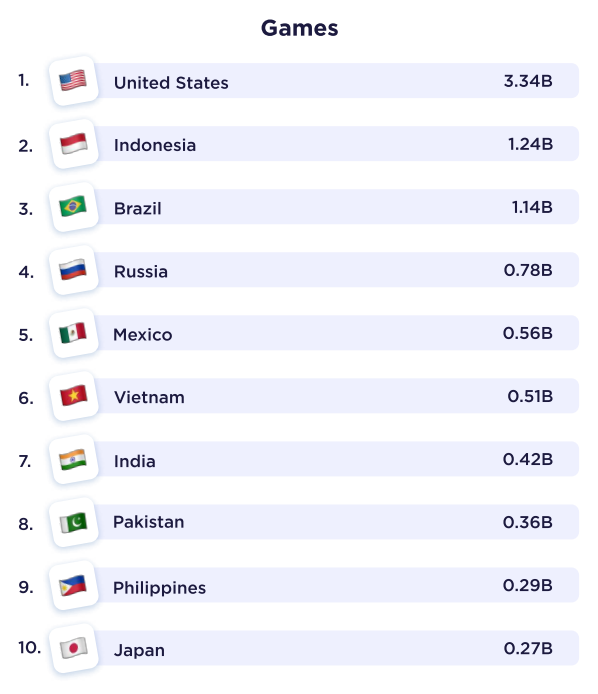

Geographically, things have not changed much; the top 10 countries by game downloads look almost identical in 2021, with the difference being as follows:

India consistently leads the list of leading countries in terms of the number of mobile games installed; only Turkey and the Philippines have changed places further in the list, the composition of the top 10 remains unchanged.

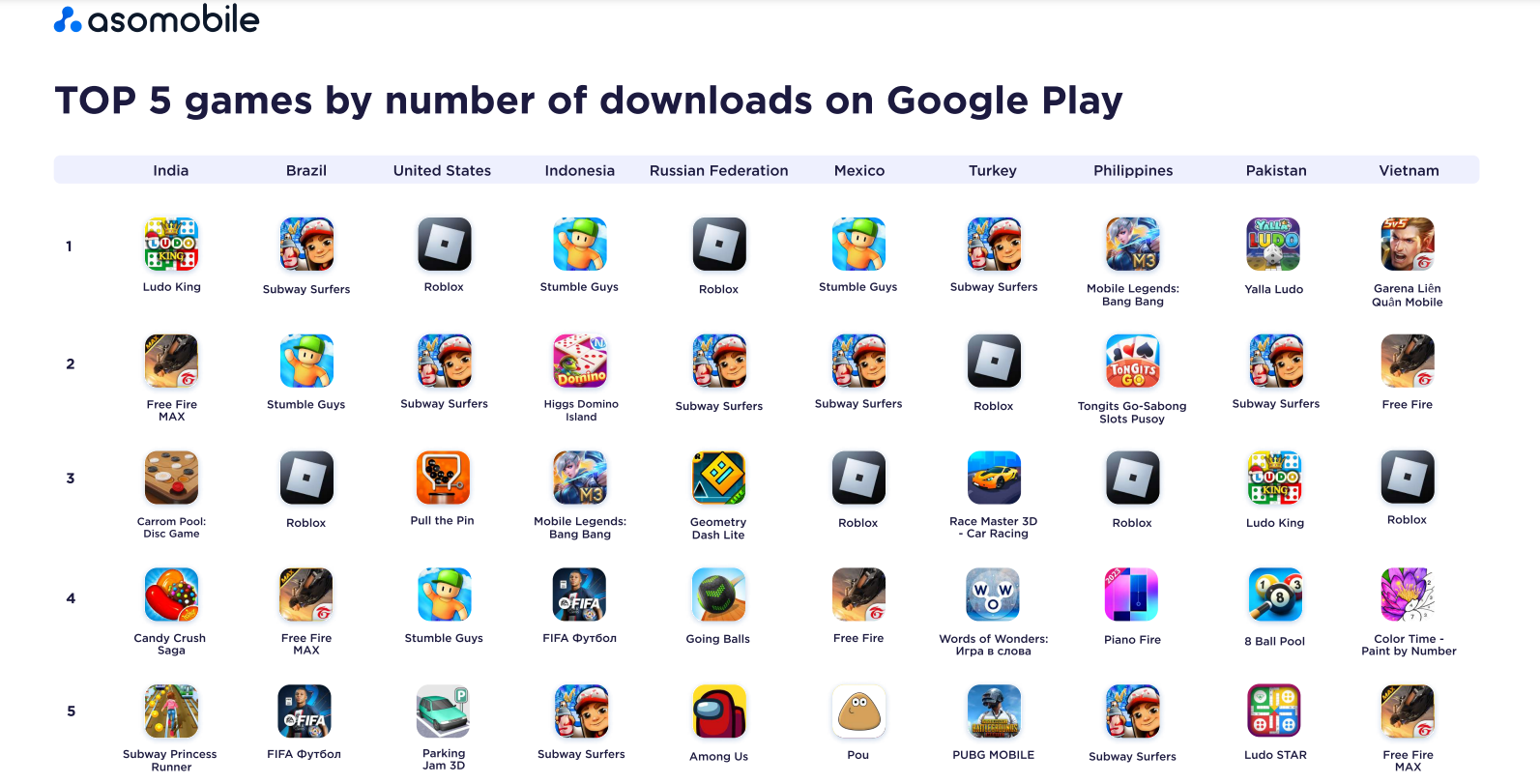

But the Top 5 mobile games in terms of the number of downloads look interesting in terms of geography:

Roblox enters almost every top 5, except for India, Indonesia, and Pakistan. Subway Surfers demonstrates its popularity in almost all regions of the top 10 download countries. Interesting fact - in none of the above countries, you will no longer meet Among Us (except for the Russian Federation), although last year it was in all dozens of countries.

Revenue

The top 10 revenue categories on Google Play at the end of 2022 looks like this:

Notice how the top 10 by downloads differs from revenue even though there are apps in that category as well. RPGs, Strategies and Puzzles rule the roost here, and we can conclude that the number of installs does not always directly correlate with the profit indicator.

In terms of revenue, the Top 10 countries are as follows:

This looks pretty familiar, aside from a sharp rise in mobile gaming revenue in the UK (ranking #7 in 2021) and a drop in revenue in Germany.

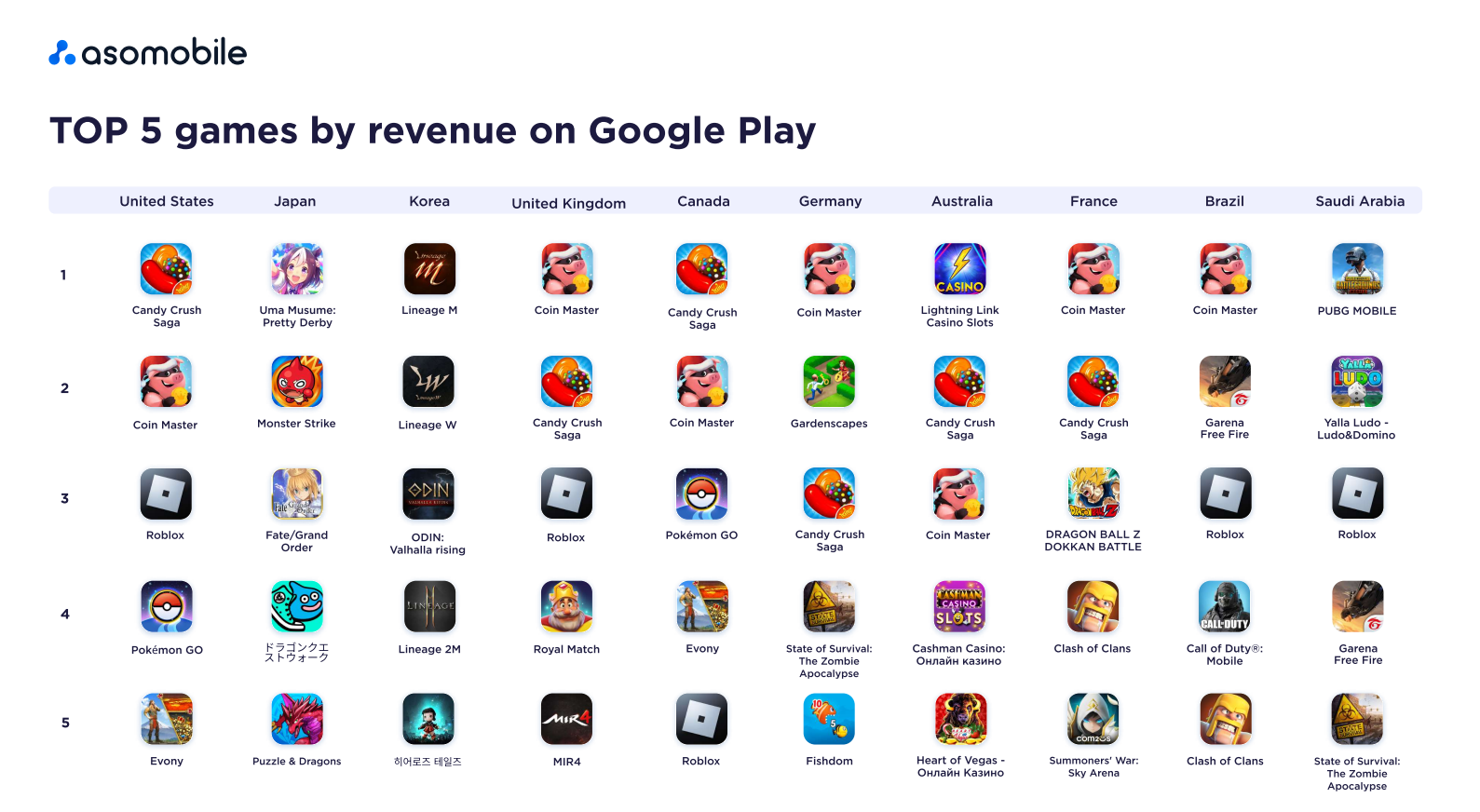

If we are talking about revenue, then the Top 5 Google Play games look like this:

Roblox продолжает занимать места не только среди лидеров по установкам, но и по прибыли! Заметьте как изменилась география, в отличие от количества установок - здесь мы наблюдаем доминирование азиатских стран, сразу же следом за США. Самыми же прибыльными мобильными играми на конец 2022 года можно с уверенностью назвать - Coin Master и Candy Crush Saga.

Overview of the mobile games market based on iOS

iOS apps have traditionally outperformed their Android counterparts in terms of revenue and are inferior to them in terms of downloads. What is happening in the gaming sector? Are these trends continuing?

Downloads

Categories of games in terms of the number of installations have changed places compared to last year. At the beginning of 2023, the Top 10 by downloads were led by Action, Arcade and Simulation. Pushing past the leaders of last year - RPG and Strategy.

As for the leading countries, we see significant attitude changes in 2022. Invariably, only the first place belongs to the US market, but last year's leaders, Japan and Great Britain, went down the list, losing to Indonesia and Brazil.

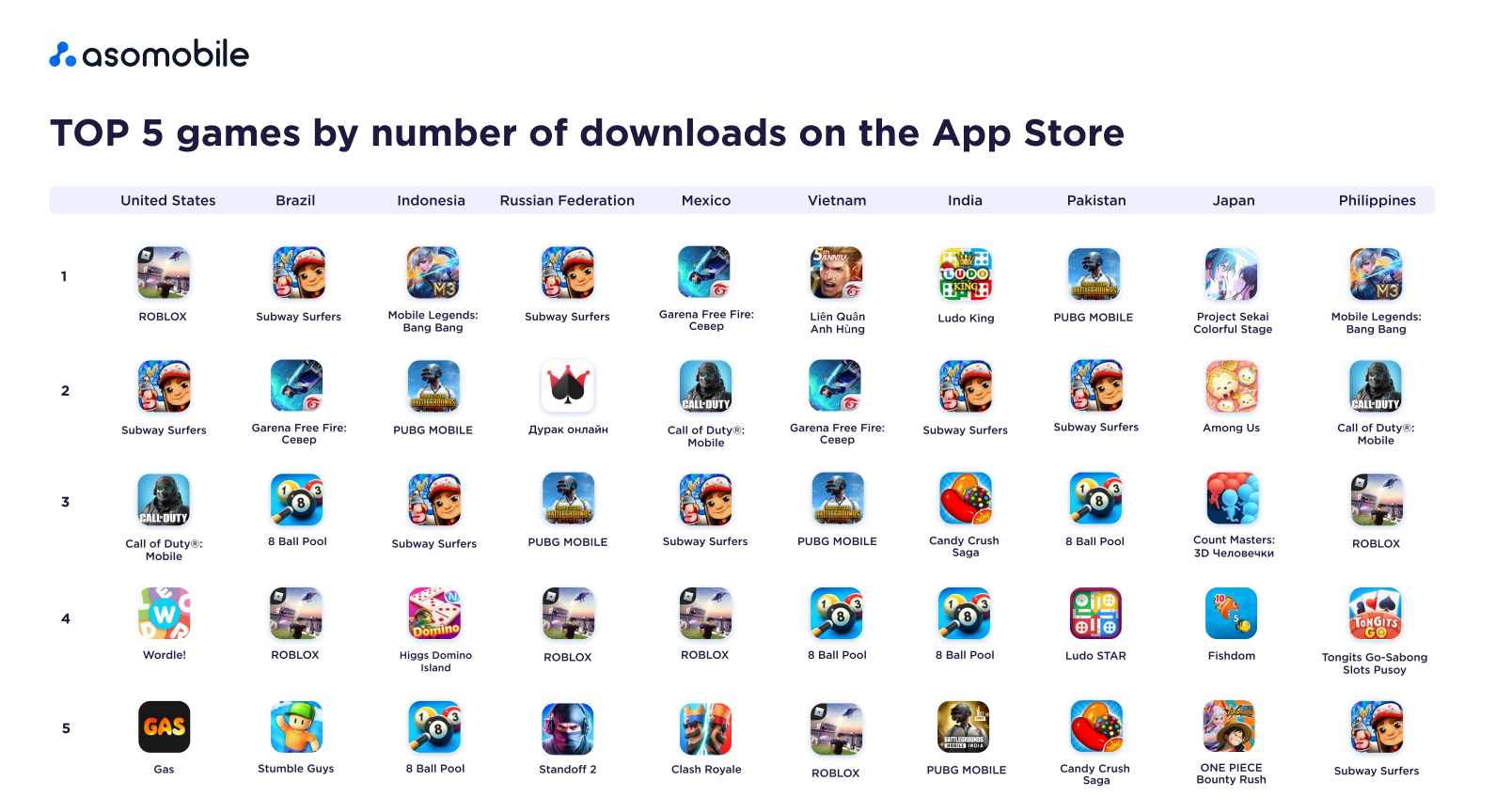

Top 5 by number of installs based on iOS are as follows:

Subway Surfers holds a strong leadership position in almost every country out of the top 10 in terms of the number of installs based on iOS. Roblox shows excellent results here too, although not in all geos. If you are not too lazy and compare these statistics with Android applications, you will get an interesting picture of user preferences in terms of platform and country.

Revenue

Revenues from various categories in the App Store, as well as in Google Play, lead mobile games. RPG and Strategy take the lion's share of iOS app profits in the overall sector.

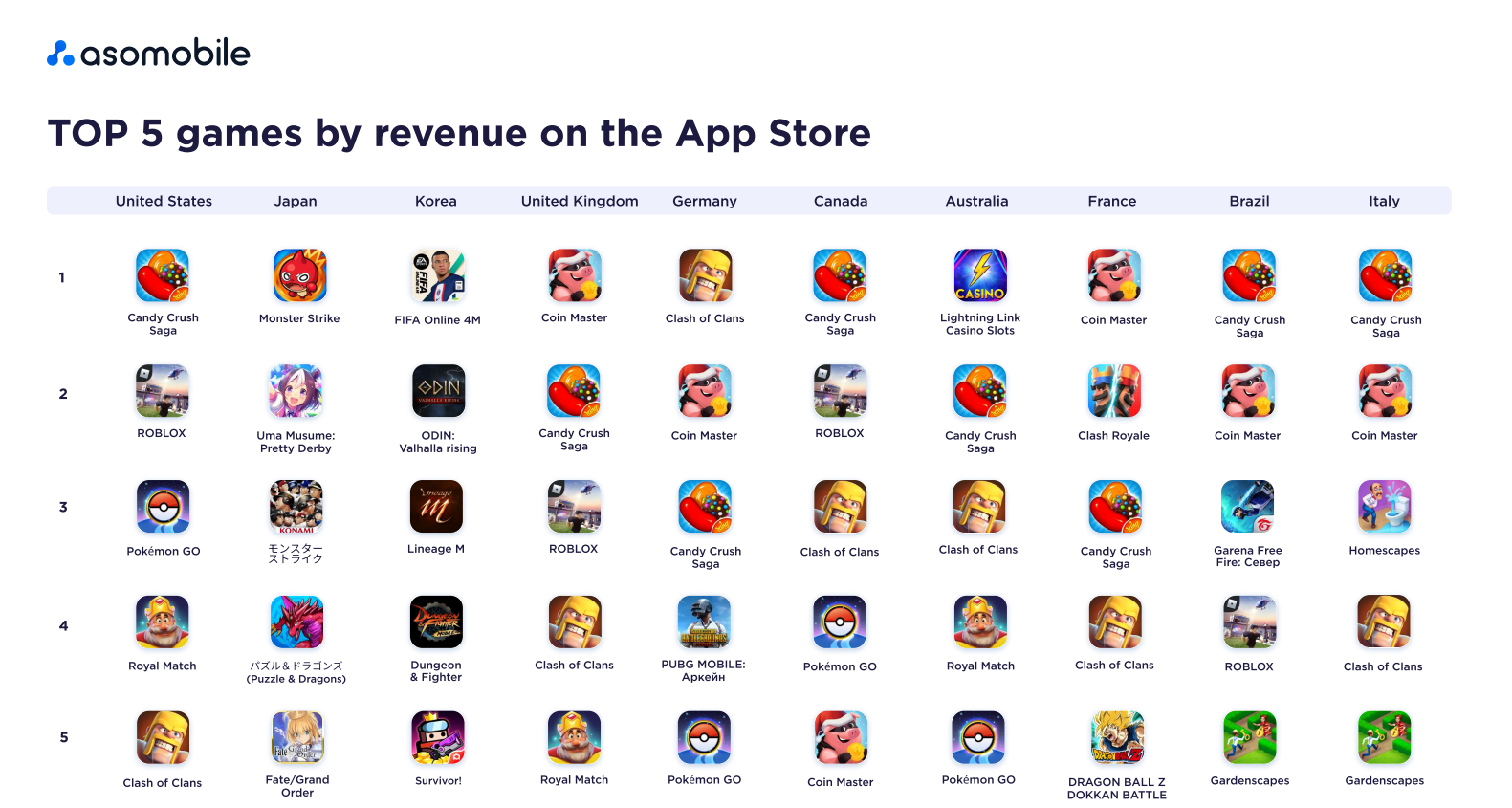

The top 10 countries in terms of mobile gaming revenue have been led by the United States for many years now, accounting for almost half of all mobile gaming revenues. Japan and Germany are traditionally close to the top three. The biggest surprise was the rise of South Korea in the Top 10, which almost doubled its revenue compared to last year.

And the most profitable iOS games for 2023 were Candy Crush Saga and Coin Master, they are in the Top 3 in almost all countries of the mentioned top ten. Roblox Clash of Clans has slowed down a bit but still dominates many geos in terms of mobile game revenue.

Marketing the mobile games market in 2023

What can I say, the crisis will not pass away, and this is the mobile market sector. But games will continue to conquer new heights, get new users, and delight developers with a sufficient level of profitability, especially when compared to mobile apps. What do you need to pay attention to so that your game projects can boast of all this?

- More targeted advertising spending - the tightening of the competitive field has led to the fact that advertising has become more expensive, and its effectiveness has decreased. But do not be discouraged; you may have to control the budget for promotion more carefully, but this will lead to the desired result. Moreover, we see the emergence of new channels to attract users, such as CTV and others.

- New geos - we keep reminding that the US market generates more than half of all gaming industry revenues. Therefore, it is not only possible but also necessary to use this opportunity - here, you will find excellent opportunities seasoned with a high level of competition (nowhere without it). But the growth of the Asian market continues inward optimism and opens up great opportunities. No need to look far for the numbers; according to AppsFlyer's report, simple Android mobile games in the Philippines accounted for 30%, while Indonesia's growth on App Store games jumped 64%. And all this against the backdrop of falling markets in China, Japan, and Australia.

- genre preferences. According to the year's results, advertising expenses increased, and in terms of genres, they are ahead of the rest of the planet, 3 in a row and casino. In principle, both platforms showed us an increase in budgets for UA, which already shows us the trend of the current 2023 as well.

- If advertising is expensive and not always effective, you need to look for ways to attract your target audience. The cheaper and more efficient, the better. Thus, we draw your attention to advertising using push notifications, messages in the application, and much more. This is a great and, most importantly, cheap way to re-engage users. For games based on Andriod, remarketing has received almost a rebirth.

- Changes on the part of platforms - the tightening of requirements on the part of sites (we are talking about SKAN from the App Store and Privacy Sandbox from Google Play) leads to the fact that developers and marketers will look for new platforms for placement, and we are talking not only about alternative stores but also about PC and consoles.

ASO for mobile games in 2023

Optimization does not stand still and develops along with the market, sensitively responding to all the undercurrents and changes. Therefore, when conducting ASO for gaming applications, we will take into account:

- geographic trends. You need to open up new horizons and localize your game page on the store to reach a large part of the audience (especially if the gameplay allows, you can stop there, avoiding the cost of internal localization).

- keywords. They remain the basis of everything; constant monitoring, research, and updating of semantics do not lose their relevance.

- platform innovations. The A/B testing tools from the App Store announced in 2022, are expected to be similar to Google Play. Among the expected changes for 2023, Apple is potentially opening up iOS to third-party app stores in iOS 17.

- user acquisition. CPP will gain relevance not only for applications but also for games. Custom Product Pages will be your trusted user acquisition tool. Android with Google Play offers great re-engagement features, as we mentioned earlier.

- artificial intelligence (AI). Using GPT chat in optimization can be a handy tool to improve the quality of content, but it is still a matter of the future how useful AI can be within ASO. But we can definitely consider using AI for imaging. For example, DALL-E is for generating visual elements of your game, both for the internal interface and gameplay and for decorating the game page on the store.

We will continue to follow the trends in the gaming industry, and soon, you will find a detailed review of the most downloaded mobile games on Google Play over the past year. We keep you updated with changes, updates, and insights.

Українська

Українська  Русский

Русский  Español

Español